Profitable Betfair trading strategies

One of the most common mistakes I see from people who are just starting out, is that they feel the strategy they are using is the most important thing.

They go on an endless search for this elusive Betfair trading strategy that will deliver profit after profit. But the reality is that profitable Betfair trading will only happen if you have a positive expectancy. So the core of any Betfair trading strategy simply HAS to be getting a positive expectancy.

Nearly all the strategies you will see, will be based around a win rate. I’ve never seen any lay out the expectancy and ultimately that is what you need to focusing on.

Trading Expectancy

So as we come to the end of this blog post, the thing that I want to reinforce with you is about your trading expectancy. The reason that we’re setting up a trading plan and that we’re defining our entry and exit, the up and down side and all of those things is so that we have some metrics to measure our trading by. We also want to do this so that we can actually begin to influence that.

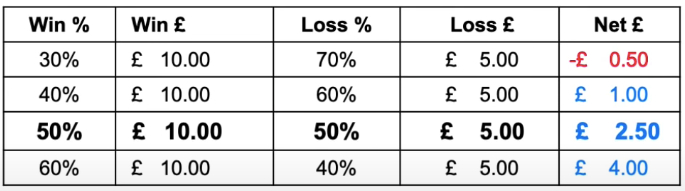

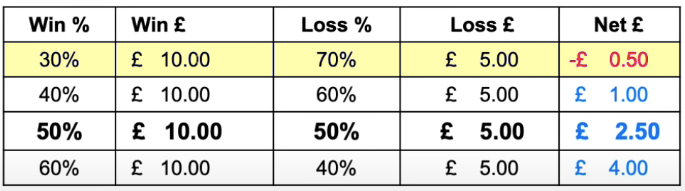

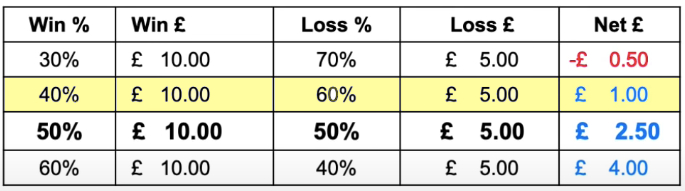

In the table above you can see that we’ve got a number of win rates and along with the types of strike rate you’ll get when you do these types of trades.

It’s not really your percentage strike rate that defines your overall profitability.

So you could have a 98% strike rate, but if you loose a lot of money when that loss comes in, then you’re still not going to make money. In the same measure, if you have a very low strike rate, then you could still actually win as long as you win more than you lose.

So very often, trading is about not getting yourself into trouble in the first place, picking key points within the market areas where they are less likely to be downside and then letting the trade run to its full extent when you get the upside.

You don’t want to cut your losses too soon because that would reduce your strike rate by the same as you don’t let them run out of control and it’s the same in the other direction. If you’ve got a good trade underway, you want to maximise it as much as possible, but not to the point where it reverses and comes back in the other direction.

So you need to measure your strike rate, how much you win when you have a winning trade and how much you lose when you have a losing trade. It’s important to have all of those three things because they will form your overall expectancy.

What you can see on this table above is, you know, we’ve got one strategy that has a 30% win rate. We win £10 every time that we do this trade successfully and we lose £5 when we do it unsuccessfully. But at a 30% strike rate, we actually make a small loss.

However, with a bit of practise, we bump a strike rate up to 40% and we actually lose more than we win. But because we’re getting half decent trades through the market, we’re actually slightly more positive.

Now your mission as a trader, should you choose to accept it, is to try and get the strike rate up as high as possible.

You also need to ensure that balance between your wins and your losses in the best ratio possible as well. Big wins and small losses, it’s not always going to happen like that…

What you’ll find is if you have a trading plan, it will basically present a win rate to your strike rate and it will also present how much you’re winning when you win and how much you lose when you lose.

Then you can start to understand where you’re going wrong:

- Are you letting your losses go to big?

- Are you not making a profits big enough?

- Is your strike rate just appalling?

- Perhaps you have this strike rate is high, but you’re taking to bigger losses?

If you have a defined trading plan, you can plug these figures together and that will tell you:

a) Where you’re going wrong…

b) but also what you need to achieve as well

If you know what that win and loss ratio is, that will define a strike rate. If you have a win rate and a strike rate, that will tell you what your losses could be.

So using all of that information together will allow you to become a profitable trader and create your own trading strategy.

Hope this blog post is helpful for you, check out the Youtube video linked at the start of the post on the matter if you want to reinforce what we just went over.