Finding value in malevolent markets

You will be forgiven for thinking that humanity is an outdated concept that should be replaced. But they do say, to err is human. But to completely screw up, you need a computer!

Flash crashes

The stock market was set up to allow companies to raise investment capital from investors. A simple and effective concept that works. But modern financial markets are more like a giant casino. You can still raise funds, but the aftermarket dominates the central purpose. The amount traded in forex overnight totals trillions and vastly exceeds the amount of goods that change hands and require foreign exchange transactions. Derivatives on equities often have more outstanding liabilities than the entire capitalisation of the underlying company. The tail is now wagging the dog.

https://www.quora.com/How-would-a-forex-trader-measure-volume

More recently the markets have experienced something more concerning, the flash crash. In 2010, the US stock market experienced a massive flash crash.

https://en.wikipedia.org/wiki/2010_Flash_Crash

When the dust had settled, it became clear who the culprits were. High-frequency trading firms looking to exploit minor characteristics in the market to make a few cents here and there.

When these short-term discrepancies had diminished due to competition, these funds started to look beyond traditional positions to create the circumstances where they could potentially profit.

Over reaction is now commonplace

Like financial markets, the tail often wags the dog in sports markets now. When you see a really poor quality race with tiny prize money matching the turnover of a much better race, you realise that there must be a fair amount of ‘ping pong’ money in the market.

Curiously, the market is much more efficient in terms of general pricing than it ever has been. Over rounds on individual markets are extremely tight. So tight, that operating as a market maker isn’t viable, but on the flip-side the amount of noise is the highest it’s ever been. The tail is wagging the dog again.

What often happens now, is that somebody places an order on the market and that is triggering a bot to react. But that sets off another which reacts to the one that reacted to the market order. Another, seeing a situation develop, that triggers another and so on. They are often being fooled by themselves and end up in a circular loop which feeds on itself.

To a human, this is obvious. But to an algorithm which has no external reference point or sense of rationale, it’s difficult a difficult piece of code to error trap. They are often programmed to exploit the system, not to make sense of it. Therefore, an error can be self-proliferating.

Exploiting the noise

A few years ago I thought that just straight backing and laying was dead because the market was so efficient. There seemed to be little room for error. The market was a thing of beauty, the wisdom of the crowd was working its magic. Prices tended to gravitate correctly to the perfect price without error. Two key things changed have changed this.

As bots battled for supremacy in the market, the spread between back and lay price has decreased to the point where there is virtually no spread. Over the last couple of days near 70% of races on Betfair had an SP of below 100%. You could back all runners and make a profit.

It’s now perfectly possible to back and lay into the market with virtually no loss to the other side of the book. If you’re moderately smart then you can do this at absolutely no loss and in fact maybe even a slight margin. That in itself was a good reason to start looking and pursuing outright backing and laying strategies again. It should be noted however that if you know how to trade, then you can increase your potential pay-out on just straight backing and laying strategy by being a little bit clever.

More recently a much more dominant characteristic has come to play. As people try and exploit the market from high-frequency trading, errors are much more commonplace now. It’s curious, the noise has increased, but typically not at the expense of the market efficiency. I started to exploit this behaviour back in 2011. The funny thing was that it was an accident that I discovered it. I started a strategy and noticed the returns were not random, as I had expected. So I started digging into the data and figured out what was going on.

If a price starts at 6.00 but drifts to 10.00 then goes off a 6.50, then one of those prices has to be wrong! From a broad analytical perspective, the market was reasonably efficient. The price at the off was near its true price. But what happened in the ten minutes before that not so much.

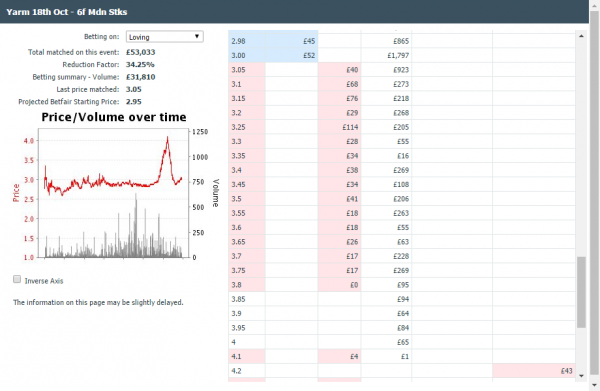

Take a look at a recent market. This image came quite some way from the start, as you can see from the volume. I saw some odd activity on the market and gave it a prod with a small amount of money. The market responded with a bizarre deviation from its true odds as one bot after another chased the price out. Eventually, there was a capitulation and back it came again. But most likely at a big loss to somebody. I had to laugh, though I’d imagine somebody else wasn’t. The deviation from the ‘real’ value is really clear to see on this chart, it’s sometimes a bit more subtle than this but still clear. (See chart at the very bottom of this post)

Ascot

At the Champions meeting in 2016, we had a very high-quality race with very well-known horses, with very strong form lines, the going was well understood and unchanging, the course bias was well understood, the weather was consistent. Everything was known about this market and yet we saw an absolutely stupendous drift on the favourite in the race.

I was busy trading this favourite and I just couldn’t believe my luck. You could see it was a little weak so I was on the lay side not expecting it to go below evens. But as that weakness translated to activity, somebody or something was really exacerbating this trend. The market moved way beyond what should have been reasonably possible. I thought that perhaps I’d misread the jockey silks and Almanzor was running loose, but no, everything was just fine and Almanzor was a picture of composure.

There was no rationale whatsoever for such a large drift to take place, especially in a group one race. You can see from the graph that not only did it drift, but the drift became almost exponential at one point. From watching the market as it unfolded you could clearly see that somebody was trying to push the price higher, but it seemed like there was more than one person (or bot) trying to do the same thing and ended up competing with each other to push the price to ridiculous levels.

You can see there was clear value on this runner either from a trading or betting perspective. Eitehr that, or did this runners chance decline by 17% in ten minutes, was that rational?

There in a nutshell, is your opportunity.

Category: Horse Racing, Trading strategies

Thank you for sharing your thoughts. I really appreciate your efforts and I am waiting for your next write ups thank you once again.

agenonline.asia , beritasepakbola88.com