Profitable Betfair trading

The essence of profitable trading, Betfair trading, betting, any trading of any sort it’s to have a positive expectancy.

That means basically winning more than you lose. When you actively trade, it’s a little bit more complicated than that. But in essence, you’re looking for those sort of positions within the market.

So if you want to be long term profitable, you need to find a position in the market that will win more than you lose. It’s a little bit more complicated than that but I have done a video on this talking about strike rates, how much you win when you win and how much you lose and all of those things and how they will work together.

Have a watch of the video if you want to understand this concept in full.

Finding profitable trading set-ups

If we look at this from a market trading perspective, I’m always looking for positions within the market that allow me to get much closer to that particular goal. We want to find positions where the threat of a loss is much lower than the potential payoff. We want to find positions where you sort of put yourself roughly in the right place.

So if we’re talking about horse racing on Betfair and trading horse racing much, you’ve got a traded range and you’re at the bottom end of that traded range. You can see a number of reasons that you don’t think that the price is going to go much lower.

So you could lay at the low end of the traded range on the ladder and hope that the price starts to head back up in the other direction. And if it doesn’t, then it probably doesn’t have that far to fall because there’s some fundamental sort of barrier stopping it from there.

The opposing situation is a good set up also. But if you’re in the middle of a trading range, you could sort of say that your potential profit and loss is equidistance. It could be a positive or a minus and it’s harder to pinpoint in the latter case.

But essentially, you’re looking for positions where you’re minimising the amount of downside that you’ve got and you’re looking to gain as much upside as you possibly can.

Finding a trading that’s stacked in your favour

So how would you like to find a position in the market that has a roughly two to one payoff by default?

The interesting thing about trading and horse racing, we know that it’s purely driven by opinion. There’s nothing that will generally speaking alter that characteristic. So the market sort of meanders around all over the place and you’re trying to spot positions within the market that give you the ability to put yourself in a better position to profit.

There is one situation within the market that occurs on a regular basis that I am actively seeking. You may have found this or seen me do this in a number of videos in the past. If you go into the Academy site or you watch some of my YouTube videos, there are about four hours worth of me trading there and you will see this cropping up as a theme throughout those videos.

What is this point within the market? Well, it’s a crossover point.

The crossover point has a curious background to it, because it was something that I discovered very early on within my trading career, and I actually came up with the name of a crossover. If you’re interested in the background as to where that name came from, I’ve done a video on that, too.

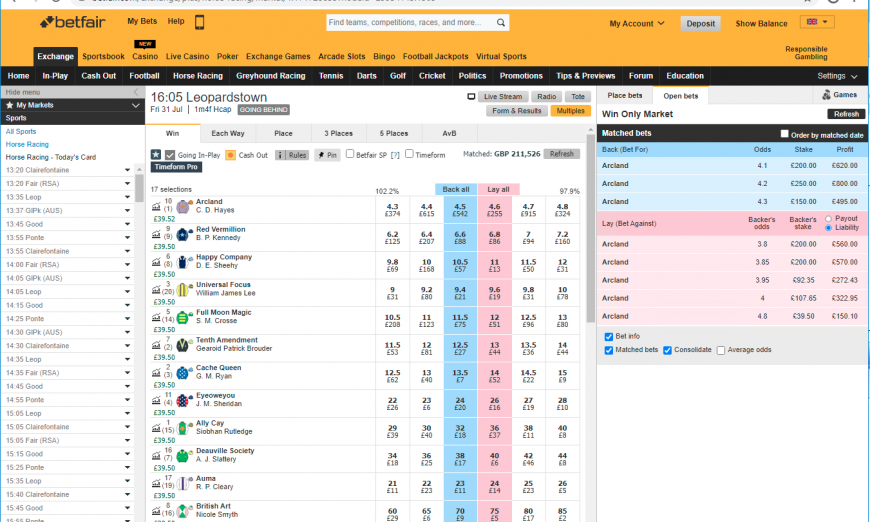

Cross over points on your Ladder interface

If you look at a crossover point, it’s the point within the market where the odds increments changes. What do I mean by that?

Well, if you look at the market when it’s centred around odds of two, you will see that we’ve actually highlighted it in a different colour. And that is to indicate that you’re approaching a crossover point.

The key facts to know about crossover points is that as the price rises above it, the odds increment changes. For example, at odds of 2.00, it changes at 2% increments on the way up the ladder, but it only down at 1% increments. So if you’re laying in the market at that particular moment in time, every time you go up one take, you get a 2% payoff. The key here is if the position goes against you, you only get a 1% loss. So it’s two to one in your favour. That sounds good, doesn’t it?

If you do something at odds of 3.00, it goes up by 5% and down by 2%, two and a half times in your favour! If you go to odds of 4.00, then you will find it goes up 10% and down 5%. At odds of six. It goes up 20% and down 20%.

So crossover points in our area, within the market where if you’re using level stakes, you will actually get a payoff if you’re actively laying in the prices drifting of two to one in your favour. So it’s a nice little point to be within the market.

Creating a trading plan

The important thing to remember is if you’re trading completely at random, then you’re going to get random results. So ideally, you’re looking for scenarios and setups near crossover points that are likely to push through that point and head higher.

In other words, you are looking for a drift within the market. So it’s critically important that you don’t just jump on every crossover point, because if the prices are rocketing in, just your desire to find a crossover point isn’t enough. You need to have a proper trading plan.

So you are looking for weak runners within the market that are approaching this critical point. So the way that I suggest you use this trade is when you are actually looking at the market itself, you are saying, “I’m looking for a week horse, a horse that’s drifting. Ideally, it will be near a crossover point.”

Summary

If you have two potential trades that you could do, but one is near a crossover point, then you’ll probably go for the one that near the crossover point. This is because it’s just got a few more things stacked in its favour, whereas the one that’s in the middle of nowhere, probably isn’t as beneficial to you and you may be taking slightly more risk.

Of course, it all comes down to you as a trader and what sort of level of risk you want and what you’re looking for. But essentially, you’re looking for something that you can lay first. In other words, a drifting horse that’s near this critical point to be able to stack things in your favour.

Watch the video for a trade that does exactly what we have described.

It seems lately that even strong favourites have a tendency to rapidly drift in the last two or three minutes, particularly in sprints.

I think the market goes in and out of phases like that. It’s probably tied to results on any particular day maybe?

It’s actually called an incremental price point now

I imagine people have rebranded it to avoid it revealing the source.