A long time ago I started modelling sports betting markets. The key question I wanted to answer was are bookmaker odds created. I knew if I could indentify if their offered odds were wrong then I could get en edge over the bookmaker. Alas, I didn’t know bookmaking that well so the idea faded, until betting exchanges came along and I could bet at odds that I knew were value!

When I first started on Betfair, I started by arbing. But soon I brcame one of the first people to ‘discover’ Betfair trading and the rest, as they say, is history.

Value betting was off the agenda for a long period of time. This was because, in the early days, spreads were wide and fill rate poor. It was difficult to get the price you wanted on the exchange. You also couldn’t get much on, even if you found a price you wanted.

In every problem there is an opportuntity

But several things changed that for me. Matched betting volumes rose over time, the books became much tighter and prices more variable. So this opened up the door to finding value bets.

When Betfair introduced the premium charge, I also suddenly had an incentive to be less efficient. I know that sounds odd, but part of the premium charge is based on the commission you generate, so generating more commission is helpful in terms of mitigating it.

I learnt how to find value courtesy of Warren Buffett. That was in financial markets but the same sort of (modified) rules apply in sports markets. Namely, that price is not value, the market is more variable than the return and human nature is unchanging. If you combine these simple elements, you can find errors in pretty much any market.

I now run multiple trading and betting strategies in a variety of betting markets. You have to seperate the strategies as the two just don’t mix because they have very different payoffs and risk. The difference between betting and trading is very easy to define. When trading your outcome is result independent and when value betting, your result is outcome dependant.

Value is tricky to find though, as the market is pretty efficient.

So finding a value bet it is tough. But Trading, accidentally, taught me where I could find value. You are trying to catch the best moments in a market and where it is likely to turn when trading. So this led me into value territory as I was able to ‘beat the line’ repeatably.

What does value look like? On average…

I’ll often make suggestions around value when I have been able to identify value bets. When I produce football ratings I point to matches that will have above or below value median results. What I am trying to say is this looks value, that is value, this isn’t. But what does value look like?

One thing it is not, is a tip. I’ll liberally scatter the words ‘on average’ into many posts as that is what value looks like.

All sports and most events show a great deal of variability and that means that it’s nigh on impossible to get things right all the time. Therefore when you see something from me, I’m not saying back or lay this item. I am saying there is value in that.

When I say that, what I am saying is that I think the chances of winning of that selection are out of kilter with my model. On horse racing it has higher odds or too little based on the true odds I have indentified for that market. I’ve spent years learning how to calculate the odds, so can’t explain in one tweet but that’s the general message.

I’ve learnt it’s really tough for people to fully understand that. When you say something is value it doesn’t mean it will win, or lose if you are laying it. You are just saying it is mispriced and will deliver a long term profit if you do it enough.

I’ve lost count of the number of times I’ve hinted that something is a value bet or trade only for some smartarse to see it fail and quote “Well that went well”. But the fact that people don’t understand value is probably half the reason it still exists.

So when I make recommendations or give ratings, be sure to interpret it correctly.

What I am saying when I post up information is that, based upon my analysis, it looks value or look for value here. I know from experience that I can generally find it. But it doesn’t mean that thing will win or lose, I can’t control that. But ultimately looking for value is how you end up with a successful betting strategy.

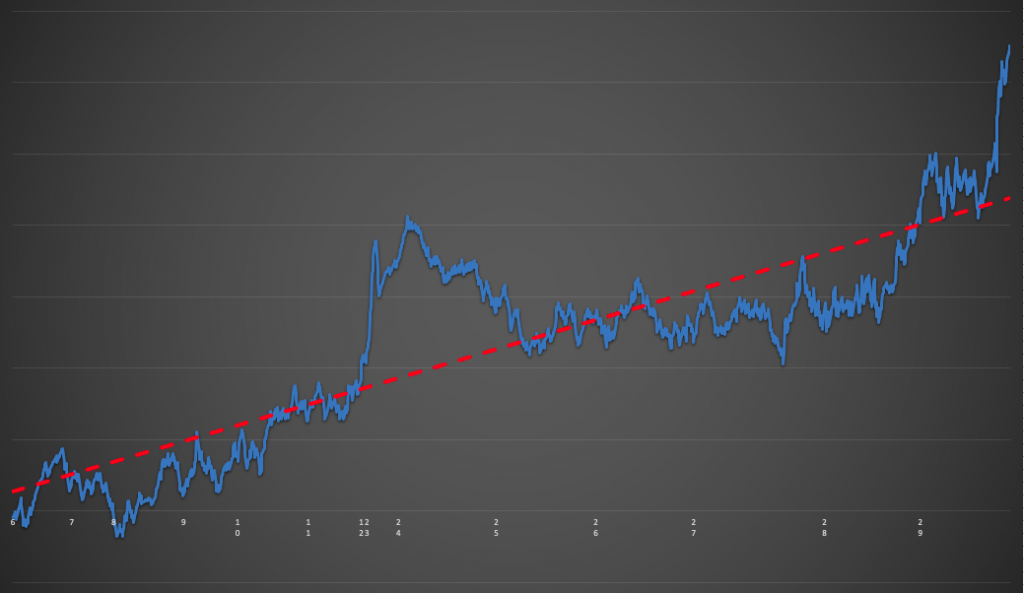

To understand how value manifests itself over time take a look at the following chart.

This chart represents a value betting strategy. I just plucked this out because I thought it was a good example. I run multiple strategies on different sports and markets and they all look a bit different. There isn’t really a standard ‘look’ to a chart.

I have an edge, but this graph shows you how variable the results are. As you can see, the road is bumpy but value plays out over the very long term.

Within that mix, you can get long runs where it’s very positive or very negative, but over the long term, you should see your bank produce higher lows during each draw-down. That’s how you know you are achieving value. Once you are certain, you start looking at how scalable the strategy is.

When you are doing well with a result dependent strategy, it’s easy to think you are a god and when you are doing badly it’s easy to think you are an idiot. This is one key reason that people have trouble replicating or even creating successful strategies.

The psychology, pressure and anxieties just get too much. You almost have to not care about the result. But, of course, that’s really hard to do especially when using real money. It’s even harder if you are reliant on that income.

I’ve learnt to be very level headed, even when things are going fantastically well. That is because I know that will help me cope when things are not going so well. Because of this, an exceptional loss doesn’t feel so bad and a big win feels like it’s just pre-paying a potential loss. All I care about is that I am up at the end of the cycle.

Rather than measure any value-based strategy on a particular day, week or month. You have to measure over a much longer period.

I tend to measure my return by stakes used, that way you can track it even when you grow your stake. If you measure this as a percentage you will see if you are indeed beating the long term as this percentage will stabilise and moderate in your favour. If it starts to regress in percentage terms to the mean, then it’s quite likely you have no edge.

You can see from the dashed red line that the trend is definitely upward. But can also see some of the wild swings in fortune.

Ultimatley I can’t control that, so I don’t fret on it or congratulate myself either. I just know that’s expected behaviour. All I can do is focus relentlessly on looking for opportunities.

Why a value, outcome dependent, P&L can be misleading

Now and again I’ll post a P&L of a value strategy, but it’s important to understand what you are looking at.

You have good and bad days and now and again you go on a nice little run where you get a decent total. But in reality, any total you get, your long term yield is only going to be measured as a percentage of that. On the flip side, a day of full-blooded losses isn’t to count as losses either. As long as you have an edge you keep plugging away and let everything come out in the wash.

The most I have ever ‘earned’ from a value strategy was nearly £30,000 in one day. But of course, I never actually earned this in reality, just a percentage of that. When you have been going as long as I have, you realise that you are going to catch the odd outlier.

On that day I bet on many markets and didn’t lose a single one. Even with the best selection criteria, that’s going to be very rare! But having a P&L in the thousands in a day isn’t that rare, it’s expected. You sort of ‘bank’ that in your mind for days that are negative.

Value Betting versus Betfair trading

If you follow a betting strategy then you will find you get large swings in your P&L, it’s a sure sign that your outcome is result dependent. I may make money on any one day when betting but it’s highly variable. Over one week I’d like to make something and over one month I’d expect to be positive. Over one year you should almost certainly be positive unless you have been very unlucky.

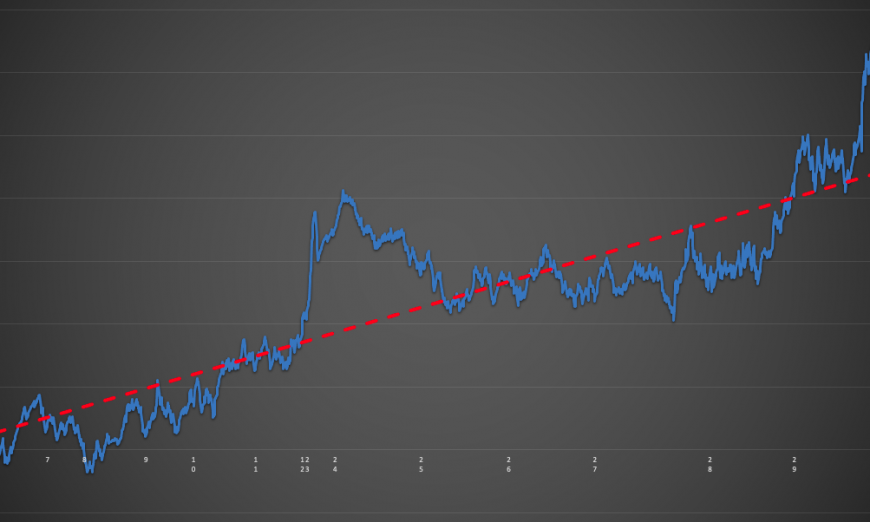

When you are Betfair trading large swings in your P&L shouldn’t be the case. Trading is all about opening a position, closing a position, maybe repeating that process; but ultimately hedging the position for a result means you win whatever the result. As a result, you would expect a trading strategy to produce a smooth upwards sloping line and be devoid of large swings in the P&L.

That is exactly what you see on the next graph which plots one strategy I have been running for just over two years. Most of my trading strategies look similar as I am aiming to win slightly more than I lose with a half-decent strike rate. On this particular chart, you can see how a tweak in the strategy has accelerated the curve fairly recently.

When Betfair trading, I go into each day expecting to profit. I can’t guarantee it, but I expect it.

Because of the number of markets I trade and how I trade them I would be really unlucky to lose over the course of a week.But underlying those facts is that when you are trading you are effectively profiting from the variability that you see when outright betting. You profit from the thing that is the very nemesis of your betting strategy.

Therefore you conclude that by betting and trading, you can have your cake and eat it!

Great article Peter! A good explanation on the difference between trading vs value betting. For me the fundamental difference in terms of implementation is that value betting involves knowing something about the likelihood of the outcomes, and trading involves knowing something about the behaviour of the market.

The short term risk in value betting can be mitigated by placing many value bets into the same market over time, managing your stakes, and by having many different strategies (essentially as bookies do – they rarely ‘green up’, but they manage risk so they don’t have to be too concerned about results).

I tend to run multiple value strategies doing different things and that flattens the overall variability.

Nice. I have a couple. I’m hoping to get enough that I can automate and not have to worry about revenue or variability.