When you’re Betfair trading or trading in any market for that matter. The number-one thing that you must have right in order to be able to trade profitably is simple…….. your mindset.

This is the same no matter what sport you are trading, it doesn’t matter the type of trading you are doing whether you are trading horse racing or football matches or whether you are trading manually or automatically. If you have the right mindset, that will give you a good head start in terms of deploying whatever strategy you choose, if not be prepared for a big loss!

Your mind was built for an era when failing to avoid danger would lead to instant death. When you are trading you still feel that pang of emotional danger, even if there isn’t any around. A string of trading losses, an improbable run of losing lay bets, a failure mid sessions to lock in a profit, only to see it slip away. All these things will make you want to take action.

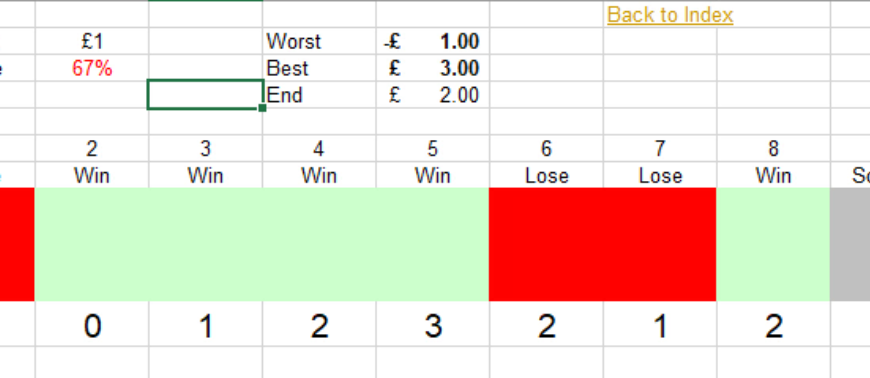

Let’s have a look at my spreadsheet and understand what we’re looking at here. The key things that you can see on here are the win or strike rate.

We’re winning twice as often as we’re losing which means it’s a good strategy. The numbered part above, from 1 to 10, these could be individual trades, it could race markets within an individual day or it could be months. We’ve got a sequence of events and we’re going to win or lose money on those. I’ve also thrown in the scratch (the scratch is a breakeven trade).

What does it mean?

If we look at the example we’ve got above, this was a good sequence. We actively participated in this sequence, we started at zero and by the end of that sequence, we’ve made seven units. You can see on the image, we scratch the first and then have consecutive wins until 9 but ended up okay overall. At the end of this particular sequence, you’d probably be feeling pretty happy be thinking you did a really good job there and this is how most traders think they’re trading.

Trading messes with your mind…

But the easy winning example we have just given is not always the case. Trading messes with your mind and that’s where it unravels a lot of strategies and a lot of money management because traders start to alter what they’re doing based upon the results they have just achieved.

Your trading results should be independent of each other, but that’s rarely the case if you are actively monitoring your results. Even if you trade automatically or semi-automatically, a bad run can force your hand and make you jump in so that you can ‘correct’ something that’s gone wrong.

This spreadsheet has been designed fairly randomly, so the idea is the overall strategy is profitable over the very long term however over the short term you’re going to see variances up and down.

Let me describe briefly what we see on the next image. We won on the first iteration, lost, scratched, won, scratch, scratch, won, lost, lost and then by the end of the sequence we’re back at zero. If this was your trading day you’d be disappointed and feeling as if you couldn’t get anything right, but the fact is this is the same strategy as the image above but this is over a very short period of time.

You can see we were in profit and then we lost it so how do you think you’d feel at the end of that day when the previous day it was just a string of winners?

If you had a day of profit, you would probably go into the next day and thinking, well you know what I’ve absolutely got this sussed so I’m going to double stakes and I’m going to really go for it today. Then boom! You get a day like this. You then reach the end of the day and you’re back to thinking hmm maybe I haven’t got this completely sussed.

Let’s flip to the next sequence and see what happens.

So start off with a loss and then we get a string of winners and then we get a couple of losers and then the day sort dies out or so it appears. Because we’re looking at it on a spreadsheet you can see this is not the case every trade is independent of each other trade. So try to adopt this mindset in real life when you are trading to improve your mental state when trading.

Manual and automated Betfair trading strategies

Manual traders suffer from mind over matter more than anybody. Self-doubt and fear play on their minds significantly and the funny thing is with automated trading this can happen as well.

If you started at a loss (as with the above image) what you should do, to have completely unbiased unintended consequences, is you look at it at the end of the day. You can then see things more clearly, with the above image you’d think, oh, I’m two up today it broke even yesterday and it made loads of money the day before. It’s all going well.

However, if you looked at it mid-session and you can see that it was up heavily and then it started to slide away then you may be tempted to turn it off and thus be worse off in the long run. You would have switched off your automation just at the moment it was at its worst run and you would have failed to capture the rebound.

The temptation to get involved is great but you can’t let yourself do that or you will be at high risk of losing out, instead, you need a very clearly defined strategy, money management and execution, maybe even a set sequence of events that occurs as you execute. Then you just repeat it relentlessly. Don’t modify your behaviour as you go along.

This looks like a shocker but maybe not as bad as it could have been because it was minus three at one particular point.

Here, we know from the spreadsheet, it was a fantastic day.

But of course, this is just refreshing this data randomly, using a random seed generator and applying it to this particular win rate.

Can you see the wild variance that we get on an individual basis? That’s what traders have real problems coping with. Whether it’s in a predefined strategy that traders are using, whether they’re manually trading or using automated trading. Everybody experiences these, despite the fact the strategy is long-term profitable.

When you win lots of money on a betting exchange, don’t suddenly massively increasing stakes.

When you lose money on a betting exchange, don’t think you’re doomed, that everything’s changed is why the world has ended.

You just have to be really consistent. It helps if you don’t check on what’s going on during the day.

Learning to cope

At the start of a strategy or trading career, some of it will be a bit down to luck. But if you do it for long enough then the strategy will shine through and you will be able to make money from it.

However, attempting to measure targets getting emotional about individual trades, days or weeks doesn’t work. If you have a great trade, don’t credit yourself too much and if you have a terrible one, don’t punish yourself too much. Just keep ploughing along that path and deploying the strategy as sensibly as you can and that will work out for the better over the long term.

The funny thing is, loads of traders just cannot and will not do that and that is a function of the way that the market works. Don’t set targets, keep your focus and focus on not only the strategy that you’re using in the money management but the execution as.

If you can do all of those three things, then you’ll have a profitable strategy and you’ll be a profitable trader.