What is the most common cause of losses?

When people stumble into Betfair trading it all looks pretty easy. After all, a quick Google will lead you to countless gurus and Betfair trading strategies that seem to practically print money. All yours for £35, but hurry as the price is going up next week!

You will be pleased to know, that I can confirm Betfair trading is a valid way of participating in betting markets. It’s quite simply the best, maybe the only way, that anybody has been able to make money through betting over long periods of time. It’s great!

Here is this conundrum, Betfair trading is simple, but not easy. As is often quoted in financial markets, it’s the hardest way to make an easy living.

Having spent years trading financial markets, I had a head start on Betfair trading. But even then, I still had to battle some demons. My early attempts at trading financial markets were disastrous, but when I turned my hand to trading on Betfair full-time I had learnt my lesson.

However, it seemed harder to understand why people kept making the same mistakes. Here is what I learnt from watching others trading well, but still losing money. You will be interested to see people making errors, but generally not with their trading.

You know how to trade, so why are you still losing money?

Do you feel as if you have the ability but are still losing your money?

Well, I can give you a really quick answer to start with. Trading is very counterintuitive, this will tell you why most people lose money when trading. But there is a longer answer and that’s what I’m going to talk about here.

Example:

Typically, in a sports betting market, a price starts on one side and then goes up or down, for the sake of this example, let’s say it’s going up. The price goes up and you make £200.00 on the Betfair exchange you hedge your position and order your Sunseeker! OK, generally speaking, you would make a small profit unless the price movement is huge. But you get where I am coming from.

So, that’s quite simple, right? The price starts in one place, goes up and you end with a profit. You could be looking to do some swing trading, looking to lock in a profit with a long term move and you just need to guess the direction.

That’s how most people think that the market works. However, the reality is completely different.

So price starts at one point and ends at another point. The way that the market works is: The average result in the market tends to be zero, so the distribution of gains and losses tends to centre around zero, and that would tend to occur if you’re in a market that’s producing roughly random returns.

So, look at the bell curve, at the top, you would see a certain level of return, you will see a lot of returns around the middle and then it would tail off a bit towards the end. You would then decide where you think the results would finish.

Now let us say that we’re looking for a particular setup (and that’s what you should do when using trading software, you should have the approach of thinking the market is going to do certain things for the following reasons) we’re looking for a set up where the price is going to drift, there are a number of setups that you can use to do this. We know the price is going to go from one point to another, and we can be pretty certain that on average it’s likely to happen.

Of course, we are hoping to get it right more times than we get it wrong and that’s where we’ll make our profit. However, and there are many reasons why you may never see that profit because the market doesn’t actually always head towards a particular price.

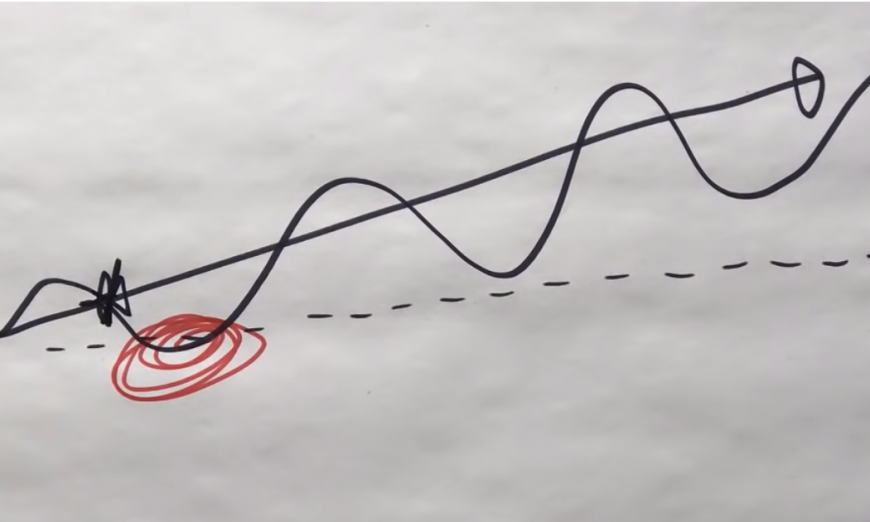

That image shows the path of desire, so we know it’s going to end up there, the path of desire that’s pulling it in that direction on the betting exchange. But what actually happens in the market, is the market never goes in a straight line!

If you trade at random over a very long period of time, you’ll get positive and negative results which will balance each other out and you’ll end up at zero overall. But, of course, you’ve got to pay a bit of commission, so that detracts from your positive values and you’ll end up slightly net negative overall.

The market will go up and go down and test your patience, before finally ending up at that particular point – that is the status quo of the market. That is the way that the market tends to work, it doesn’t tend to go in one direction. As seasoned Betfair traders will tell you, especially in horse racing, a market on Betfair rarely goes in a straight line.

If you open and close a position automatically by laying at the start and hedging later, using this trade you’d make a profit. But if trading manually and you are watching and acting on the position, at various points within the market you would come under a lot of psychological pressure.

So initially, the market is going in our direction and we think this is great. But then the market turns around and abruptly starts to go against us, which piles on the pressure.

Now you are faced with a choice, remember you can’t see the rest of the graph. So do you hold your position? When you see me trade I keep a list of things in my head that says what I want to happen and if all of those things are intact I will hold my position, even if it starts to go against me. But a lot of people can’t do that.

So let us say that we actually join the market a bit later and our position goes against us immediately, then the problem that we’ve got is that it looks like it is heading in the wrong direction and you trade out, only to see the market move back in the other direction! Trading can be very frustrating.

Summary

That is why trading is hard, people find it very difficult to cope with these little bumps that occur within the market. These are frequently seen on horse racing markets. The decision that you made in the market may be completely correct, but the fact that the market is moving against you creates a major issue for you psychologically.

A lot of positions may show a loss at some point. As the position goes against you, the temptation to cut your position is incredibly strong because it’s human instinct to fear a loss. But as you travel down this path towards the closing position it may have been actually better to hold that position in the market for a period of time.

This a common reason why I see people end up making a loss when I would have made a profit in the same market, they just get freaked out by the volatility. Getting used to that is a key part of the learning process when trading. The longer you are in the market and the more markets you trade, the easier you will come to terms with this aspect of trading.

But also, create some structure around your trade. Create a checklist and score yourself against that checklist. Recorded your trading, play it back and learn where those key pressure points are so you can learn to undo your inbuilt instinct.

This is probably one of the key things I’ve learnt about trading. Whether I trade with £10 stakes or £1000 stakes, I act exactly the same way. But it’s something that I’ve learnt to do and over many years and through many markets.

So while it’s something you can overcome, you only tend to do that with experience. That’s often something people aren’t willing to stick with long enough to make a real difference. But it’s something that you should definitely do if you want to be successful in any trading market.