So when you’re Betfair trading, there are some things you must know in order to be an effective trader and there are lots of mistakes that people make when they first start trading or looking to implement their favourite. Betfair trading strategies.

If you are trading on Betfair horse racing markets, there are many things to look for, but there’s one thing that I look for in every market and it’s something that you should do to. So we’re going to discuss what that is and how it can help you become a better Betfair trader.

You don’t need a big bank to trade with

If you trade regulary on any horse market you will realise one thing clearly, you don’t need a big bank to trade effectively. There are seveal key reasons for this.

First off, the action in pre-off horse racing comes very close to the start of the race. Thiis leaves little time in most markets to build up big totals.

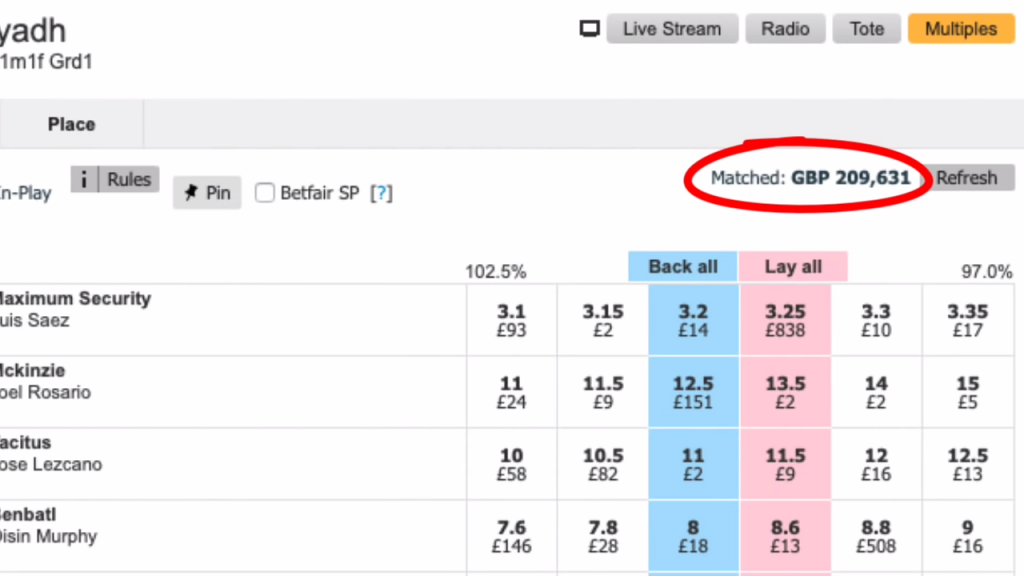

The average horse race has matched bet totals of around £400k. The key to understanding this amount is that it is double-counted. This means ‘only’ £200k has been staked on the market. If you place a back bet of £10 then Betfair matches it against another £10 of lay bets and that means £20 has been matched in total. So even if you managed to get a £10k trade through a market you would be 10% of the market, that’s huge!

Your trade size is really not decided by the market size, but by the amount of unmatched money. This is because you will need to exit your trade at some point, so your strike rate will plummet if you go over that amount and your exit has to wait in the order queue. The bigger your stake, the harder it is to get matched.

This all sounds a bit depressing so far, but it’s not. Even if you can only put £500 through the market, you can do that more than once and that ultimately is how you should trade. Do one trade, if it goes well, you can do another. This is hugely advantageous for smaller traders as you can trade with small trading banks. I consciously restrict my average stake as I’ve learned that this increases my chance of a successful trade.

So your stake is more or less determined by the market, but all markets are not created equal. Some do large volumes and some do not. But within them, there is a key to how a trading strategy works much more effectively.

Volume is not liquidity

Betfair trading is really simple, isn’t it? You open a trade, you close the trade and then you hedge it to lock in a profit and you win money regardless of what happens in the underlying event…

…oh, how we wish it were that simple!

If we look into that simplistic idea of trading it’s fairly obvious that you’re going to open a trade because you think it’s going to be profitable.

You wouldn’t open a trade, just at random; typically you’re going into a trade with the intention of trading out for a profit. It’s naive to assume that every trade that you open is going to be perfect and you’re going to profit on every single one. So at some point, you have to make one of three decisions.

- Do you close your trade for a profit and where?

- Do you get rid of that trade? For example, you open a trade and then realise you’re not too sure about the decision so you get out.

- Perhaps you want to close for a loss. You hold the position in the market for a period of time and then you realise that you’ve made a mistake and therefore you need to exit.

Entering the trade is relatively easy. You just take a position in the market and then you wait for that profit to come rolling in. However, the exit side of it is the area that you should also have equal emphasis on.

I’ve just said you don’t open a trade at random, but you could do and you could still make money depending upon what your exit position is. On most occasions, I would recommend you typically go into a trade with a certain set up that you’ve prepared. Then you would have to make a decision at some point, if the price goes in your favour, of closing out that particular trade.

You’re also going to have to make a decision now and again as to whether you get rid of that position. When I actively trade a market, there’s one key metric that I’m looking for that determines how I get into a trade, but also how I manage the trade when that particular trade is underway.

The interesting thing is that I tend to not find a lot of people discussing this or fully understanding what the particular scenario is. If you look at the way that most people look at the market, they turn up to the market and see the market has a lot of volume and they do a trade.

But in fact, what you should be looking for is liquidity. Volume does not equal liquidity.

Know the difference

Liquidity is probably the most important thing that you can look for in a market before you actually trade it.

When you look at any sports trading market, depending upon what sport you’re on there will be periods of time when the liquidity is high and if liquidity is high, it opens lots of options for you.

So let’s say, for example, we put a position into the market and then we have to do that closing position. I’ve described one of three scenarios that you may choose to do, break even, a profit or a loss.

However, when you get into the market the most important thing is actually being able to exit your trade. So let’s say we’ve got a large position in the market and there’s just not enough money coming through. What we’re going to have to do is chase that price as we go to exit the trade.

If you end up doing that it is because your original stake is too big for the amount of liquidity within the market. So if you have a high liquidity market, the great thing about that is you can change your mind, you can change your position in a flash and It doesn’t really matter!

So when you look at those big markets like your Cheltenham or big football matches you’ve got the ability to push money in and out of the market very quickly.

When I chose to trade the Cricket World Cup I absolutely loved that the market not only huge volume because some of these matches were doing £50 million or more, but there was huge liquidity as well.

Now it’s important to draw a line between the two. What is volume? What is liquidity? They’re two entirely different subjects altogether.

Let’s start with volume

Volume is simply the amount of money that you get matched on the market. It doesn’t matter when the money was matched, it’s just the total altogether.

So what makes liquidity different?

Liquidity is the amount that is getting matched at the moment of which you are actively trading it. So you could have a market with £50 million in it and no liquidity because that that money has come into the market over a very long period of time to build that £50 million. It just happens at the time which you’re in the market is really not a lot going on.

Therefore, the problem that poses for you is that you find it difficult to get out of a position. Now it could be that you’re trying to close for a profit but because the money isn’t available and it is not getting matched, then you have to take a worse price and therefore your overall profit is lower.

Another way to look at this is if you’re trying to scratch a trade, you may just not be able to get the money out of the market quickly enough to be able to get away with a zero. A scratch trade is basically if you laid something at 4.7, you would back it at 4.7 for net zero.

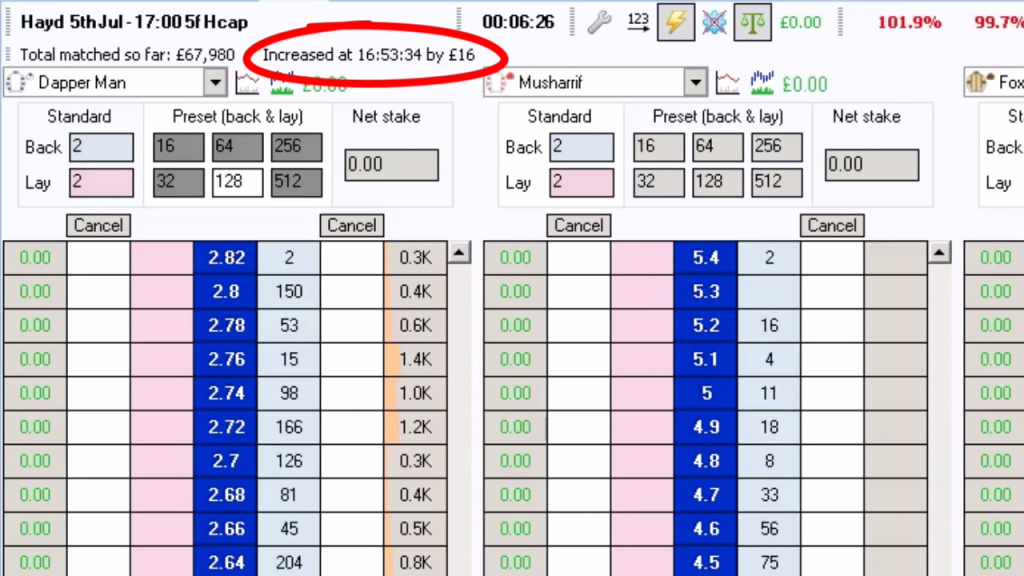

When I’m actively trading the markets over the shorter term and for small amounts, I very often will scratch a trade. This is because what you’re doing is you’re going into the market and you’re saying, here’s an opportunity and then you realise it may not be, so you pull it quickly back and then you try again and then you pull it back again. So you’re prodding and probing the markets. You’re actively trying to look for positions that look favourable and then eventually you will find one of those positions. However, the ability to just pull that trade out for zero is quite a useful tactic to use if you’re actively trading.

Now let’s also say we go into a market that’s matched a few million and our position goes really badly against us. Trying to get out is a nightmare if you’ve got a position that’s going against you and there is no liquidity in the market. This is why I don’t trade early morning markets because I often choose to trade the liquidity period before a race starts because getting into a large position many hours out means that I probably can’t get out of it if it goes wrong.

What benefits does liquidity give you?

Knowing where to find liquidity is valuable for a trader. I’d much prefer to be in the market during a period of high liquidity because any position can be matched over a smaller time frame, whether it is over a minute or over a second. However you choose to measure it, liquidity is the amount of money going in and out of the market at that moment you’re trading it and it’s completely separate from volume.

You can have high volume markets with no liquidity, but it’s impossible to have high liquidity markets without also having volume.

Where does liquidity and volume differ across different markets?

Liquidity and volume does vary across markets because you may find that the amount of liquidity in the market may be spread out over a long period of time.

For example, most Aintree Grand National meetings have liquidity that continues to be quite good all the way through the day, but if you’re looking at a Wolverhampton race on a Tuesday evening in the winter, nobody’s going to bother betting on it until the last minute.

Some of that depends upon other factors, to explore this let’s look at two different markets – the US and the Australian racing.

I’ve traded Australian racing for a long time now and a strange thing happened back in the first lockdown of the pandemic when there was no racing in the UK. We saw an uplift in the amount of liquidity on the US racing and in Australian racing.

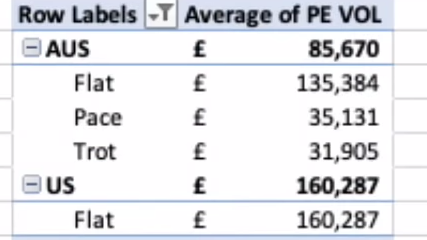

To my surprise, the average US race over the period that I monitored turned over about £160,000 and that matched volume is much higher than it previously was. I looked at the Australian racing and that was turning over £135,000 on average which also followed suit by being much higher as well.

We’re seeing that these markets have uplifted by almost 100% which is almost double the normal sort of volume that you would typically expect to see, but this is where things vary quite differently.

When looking at the American racing, I found there were 18 markets taking place that evening and some were taking place first thing the next morning. When I looked at the Australian racing, there were 149 races taking place in the early hours of the morning and running into early morning in the UK. So you can see immediately 18 races in the US compared 149 in Australia. That’s a huge difference.

But the interesting element to note is the impact that has on volume and liquidity, because when I threw up those stats saying there was £160,000 traded on average in the US, it sounded like there was a lot more money in the US than there was in Australia.

However, what you’re looking at is higher volume, but lower liquidity because the US races are evenly spaced out by about half an hour. That money is taking half an hour to build up. So if we take £160,000 divided by 30 minutes, which is half an hour, we end up with about £5300 per minute or less than £100 a second in liquidity.

So £160,000 worth of volume, £88 per second in liquidity which is relatively low. If you are staking in that market you would have to keep your stake at or around that level to ensure you could get out of your position if you so required.

However, if you look at 149 races in Australia, you’re going to see that the average is compressed into very short time periods. So the lower volume, the much higher liquidity. If we take £130, 500 divided by 10 minutes, that equals £13,500 per minute. If we break that down into seconds, we’re talking about two and a half times as much as you get in the US.

So while the volume seems lower, the liquidity is actually higher and vice versa when we compare that to US racing.

The interesting thing about this as well is that in Australia you have typical flat turf racing and harness racing. So if you take harness racing out of the equation, the volume figure for the conventional racing, which is what I’ve mentioned here, is higher. We’ve also got different grades within there as well, like with very high profile race meetings at Randwick and Doncaster.

We had the Doncaster in Australia that turned over £750,000 because it was a high grade group one. So high-quality racing brings high-quality courses which produce higher volume and higher liquidity simultaneously.

Then in contrast you have Alice Springs which was a low volume and low liquidity type of race which won’t be ignored, but they’ll be substantially lower volume and substantially lower liquidity.

But can you see, because there are so many races going off in Australia, you’ve got a shorter period of time for that amount of money to come in and that boosts liquidity.

It’s a critical factor if you’re going to actually be a successful Betfair trader as you need to be able to spot markets that are high in liquidity because the ability to get in and out of the market is one of the key components of a skilful trade.

So if you imagine you put an order in the market and the liquidity is high, then that order will get matched quickly and you can decide what to do with the counter order and the time period is relatively narrow. The longer you spend in the market, the more likely it is that a position will go against you.

But also, if the liquidity is low, you can’t dump your order if you feel that you’ve made a mistake. Also think about, if there’s lots of liquidity going through the market, maybe you could do more than one trade in that particular market.

If you can do more than one trade, you can get away with a couple of mistakes because the good ones will balance out any of the bad trades that you will do.

Liquidity is valuable to success

So when you’re looking at a market, it’s critically important to understand what the difference between volume and liquidity is. Lots of people mistake volume in a market for liquidity, but that isn’t necessarily the case.

It’s more a case of how long is that market been open? How much money’s coming through the market over a defined time period and if the markets had ages to accumulate that volume, then liquidity is very likely to be low.

However, if the market has that a small amount of time to accumulate that volume, then liquidity will be high and it will make for a much better trading market.

So next time you go into a market, make sure you’re looking at liquidity and not the volume, that’s the way that you will find a much better trade and creates the perfect Betfair trading market conditions.