Luck and Skill in trading…

Luck or skill?

On Monday I hosted a learn to trade course with the intention of giving people a decent start in their sports trading journey.

Distractions

People are always keen to see you do something when you’re hosting a course. This particular course wasn’t set-up as a full-blooded trading session. But I was happy to oblige, as there is no better way of understanding the concept if you see it in action.

Of course, you can’t guarantee that you get it right and also talking and trading is pretty hard. When trading you need no distractions to be able to trade effectively. A room full of people is a major distraction!

[EDIT : In case you have been misled on the particular comment above, read the entire blog post. Here, I am writing about talking to people about what I am doing while trading at the same time, so that obviously slows you down. But despite this, I still got 14 out of 14 trades right and have delivered similar results on courses prior to and after this one. If I trade without doing this then I, obviously, do even better from a pound note perspective. Traders in financial markets don’t have to explain what they are doing to an audience real time, they just focus on trading and that’s what I prefer to do on busy days. Despite the difficulties of talking and trading, I’m not afraid of trading live as you can see in this blog post. To my knowledge, I’m the only person who has ever done this. Again, read this entire post if you want to see everything in its true context.]

Balance

There is always a balance for me when I do training. I have to offset any revenue I get from the course, which of course includes expenses and tax, with what I could earn just by sitting down and trading. The latter I find much easier as well as fulfilling a lifestyle not chained to the same desk.

This is why I tend to do my courses on a Monday. Mondays tend to be relatively quiet on the trading front, and so it’s a fair balance. There’s no way that I could do a training course when there are big markets to get stuck into or at weekends. That is where the bulk of my trading revenue comes from, by far so I can’t give them up. Weekends, often including Friday are sacrosanct.

Solution

As well as trading live and talking through the trades on a Monday. We recently began adding Friday’s to the roster, but there was a condition. It wasn’t economical to join the afternoon session. So I join the morning session, but in the afternoon I get stuck into the markets in my adjoining office. Somebody else takes over the description of what is happening while I trade it.

On this particular day, it was clearly the right call. I had an absolutely cracking day. It was great to pop in to speak to the delegates, to show them the results as they unfolded.

It was also, somewhat, funny to see the tutor who was struggling with a cold, beg me to take over. But with the great results flooding in, I had no intention of giving up trading.

Luck or skill?

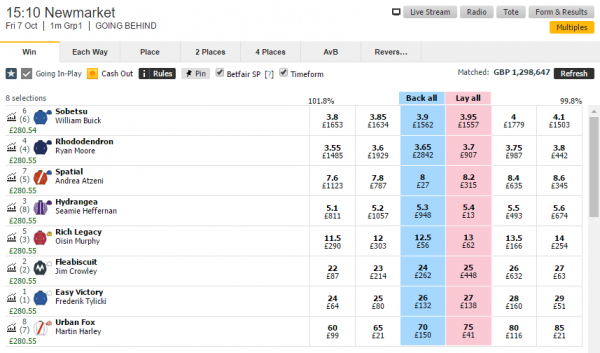

So back to Monday. I ended up trading 14 markets, while talking about them, and didn’t lose on a single one. Included was a market where I asked people to guess the direction and, despite the group getting it incorrect, I was able to trade the position to profit after the initial loss.

If you assume that my ability to get a winning trade is just that of a coin toss, a 50-50 chance, then what is the chance of me getting all 14 traits correct?

The calculation is pretty simple. If we multiply .5, representing a 50% chance I could get it right, with itself 14 times; a figure will pop out telling us what the chance of getting 14 in a row would be. It comes out to very small number, 0.00610% or about one in 16,384. I’m obviously very lucky 🙂 To repeat this feat so often can’t be down to luck either you suspect? Unless by luck you mean sacrificing years of your life to become an expert at something.

Obsessed

At one point in my career, I became obsessed with records. How many days could I go without a loss?, if I could get £100 per race, maybe I could get a thousand, etc. etc. As records came and went I began to wonder just how far you could push things?

One record I went for at one point was to see how many races I could get in a row correct. I already knew my strike rate. So, using a bit of maths, I knew what sort of number I could get, even if I didn’t try. So I had to pitch the target well above that level. It turned out that I eventually went on a run of 82 races without a loss! Some of them had decent profits some of them not so decent. On some, I just avoided a loss. But that was the upper limit that I hit, 82 races.

The number was distorted though. I tended to deliberately avoid something if it wasn’t a good opportunity. So while I hit 82 in a row, it didn’t feel ‘real’. I soon reverted to normal trading. However, if you raise .5 to the power of 82, that is an exceptionally small number and remarkably high odds. I think it’s clear it’s not down to chance. All the above examples are merely trading pre off before the start of the race and hedging before it turns in-play. I’ve always been a stickler for keeping detailed records so I have every element recorded for posterity. No trickery involved!

What can you learn

There are lessons from this for everybody. What am I doing that leads to those long runs?

First off, I tend to have a defensive trading style. I tend to be looking for positions that are less likely to end in a loss. I don’t really look for profits. I know profits will come around, even at random, so by trying to put myself in a position to not lose money; a lot of the time I don’t. Sometimes I win a little and sometimes I win a lot. I also tend to anticipate what could happen, I don’t react to the market. Reacting forces you to be its slave. Sometimes doing nothing is also a good strategy. If you can’t see a decent entry, there probably isn’t one. Finally, know just how far the market is likely to move. Knowing that will allow you to work within its boundaries, in both directions!

Longevity

I’m now on my seventeenth year in the markets. That doesn’t happen by a fluke, but it’s a moving target. I’ve been lucky enough to be involved at the start and that gives me a useful advantage. As I know how markets evolve. I know where a market is headed and how it changed when it got there, I’ve seen it before. You would be surprised how predictable this is. One thing I can’t influence however, is the growth in the underlying markets. Ultimately, if legislation changes or focus is taken away, then that will impact the markets. But outside of that, there is still a lot of work to be done.

Some strategies that used to work well don’t work so well know, but for each door that closes a new one opens. So you simply reshape your approach. That’s how you keep moving and expanding over time.

My mantra?

Luck is where opportunity meets ability. Good luck!

![]()

Category: Trading strategies