Creating a trading plan for any Betfair trading strategy you wish to choose is essential. It will define what you do and why and give you a basis on which you can operate in the market.

So let’s create a Betfair trading strategy and trading plan to go with it!

For this particular series of posts, we will focus on a horse racing trading strategy and will aim to be more generic and avoid using the specifics of trading software. We are also not going to define the amount of money that we will to make. We just want to create a structure that will allow us to trade effectively.

Also bear in mind there are many ways to do this. You could be aiming for small profits and small losses, or maybe big profits and losses. But getting it all in proportion is something we have answered on other posts. There are many ways to lock in a profit, but you need the structure to do it. That is what we are focusing on.

The first step: some organisation

If you’re going to trade effectively, you need to create a trading plan. Now what a trading plan does is that it gives you a definable boundaries.

So what should consist of your trading plan?:

- It will define your entry point

- It will define your exit points

- It will keep your emotions in check

The primary reason for doing this is so that you have something that you can replicate. If you can perform a set of actions and you can replicate those actions, then you have a chance of influencing the outcome. If you are just guessing and not working to a plan, you can’t hope to be succesful in the long term.

If you enter a market and just sort of click around at random with varying stakes you will never get any consistency. Sometimes you’ll win and sometimes you’ll lose. In the long term, you’ll probably end up losing because of commission and other reasons.

Therefore, you need something definable that you can replicate. A great thing about doing a trading plan is it keeps your emotions in check. It allows you to go – well if this is then that. However, when you first start doing a trading plan you’re going to be slow and you’re going to be behind the market.

To start with, if I’m honest, you will probably be pretty useless, but it’s critically important to have something that you can replicate and work on. Then over time you’ll get better and better at it.

The second step: practice, practice, practice

It’s a bit like riding a bike! When you first sat on a bike, you wobbled all over the place and didn’t go very far, but as time moves on then you get the opportunity to progress and get better and better.

I have an analogy to this, I’ve often said that when I’m out riding my mountain bike, it’s a bit like how I trade. I’m always on the edge of what I can do, but I know if I push it too hard, I’m going to crash…

The same occurs when you’re actively trading. There’s a bit of a balance to be had that.

You must find your strengths

Keeping the bike analogy for a while, if you want to beat the guy next to you, you’re going to have to push things a little bit harder. You will have to go a little bit faster and be a little bit fitter. A trading plan will allow you to keep your emotions in check. It will also allow you to define and replicate what you’re doing to help develop and improve your trading.

When you first do it, you’re going to be slow and it may feel like you’re not quite reaching what you want – like every learner you’re going to fall off your bike. However, with a bit of practice, you can actually push a little bit harder, be a little bit quicker and find where your edges are as a trader.

Whether this is how fast you’re willing to go, how aggressive you want to be or how soon you want to get in the market, this is where having a trading plan is probably one of the most important aspects when you first trading. You need to be able to replicate something and progress it.

So other key steps that you need to go through and you need to think about when you’re doing your trading plan, is the strategy you’re going to use.

How to get that strategy

Now, are you going to back, are you going to lay or you going to do pre-play or in play?

The first aspect you need to focus on is what specific thing are you going to do? I’ve traded the markets over a very long period of time and I’ve traded hundreds of them which gives me a heads up.

I can turn up to a market and just go, ‘oh yeah, I recognise the way the market is behaving – away we go!’

But typically that’s not the best way to do it, because what you’re seeing years and years worth of practice. I can recognise opportunities as they present themselves, but when you are starting out it’s unlikely that you would be able to do that.

So you need to pick a strategy and when you first start trading, you need to say this is the strategy that I’m going to use and the one that I’m going to practice and refine. Then when you master that, you can move on and deploy more strategies.

That’s exactly how I started, I started with a really basic, simple strategy and from that has spawned hundreds of strategies off the back end of that and with lots of variations.

This comes with experience – learned experience allows you to define it.

Ultimately, everybody starts from the same point. It’s just one simple strategy, one that is practised very well. You then branch it, evolve it and adopt other strategies and then take these to help learn when you need to deploy those.

So what market?

Now what is the next important step? Deployment – which market are going to do it in?

Just because you have a strategy doesn’t mean that it’s going to be deployed across every single market.

What you need to do is define markets that you will and won’t use the strategy in. If you apply a generic strategy in a generic market, you’re going to get generic results. You will probably lose money, so define one strategy and then learn how that works within individual markets. You may find that there are certain markets that it works particularly well in and therefore you should head down that route.

It’s a good way of cutting losses as well. If you use that strategy to market and you keep losing money in that particular market, then just bin those markets, don’t bin the strategy.

When do you enter the market?

You need a defined criteria for entry. So you need to come up with a strategy that you can calculate, so if this happens or this is the situation, then this is the point which I get involved in the market.

Of course, when you’re in the market you need to define what are you looking for, how you would define a successful trade and where is the limit of that successful trade on the upside.

If you define the upside, you’ve automatically defined the downside or you could do it the other way around.How much money am I losing with this strategy? What do I need to do to make it profitable? Whichever way you look at it, these two are interchangeable. So that needs to be part of whatever trading plan you have.

Now how am I going to define success?

Am I looking for 5%, 6%, 5%, you know, £100?

There has to be some definition of where and why you’re doing this strategy, because you need to understand what you need to do to make your trading long term expectancy positive.

Remember: you need to know before you’ve even done the trade roughly what your up and down side is going to be and where you’re going to aim that. Both of those will define your strike rates as well.

What’s the flip side?

The next question is when are you going to get out? When do you realise that everything’s gone horribly wrong and you’re going to have to live on only bread and water for a week?

It’s important to understand each of these characteristics and this will all be part of your trading plan.

Getting started

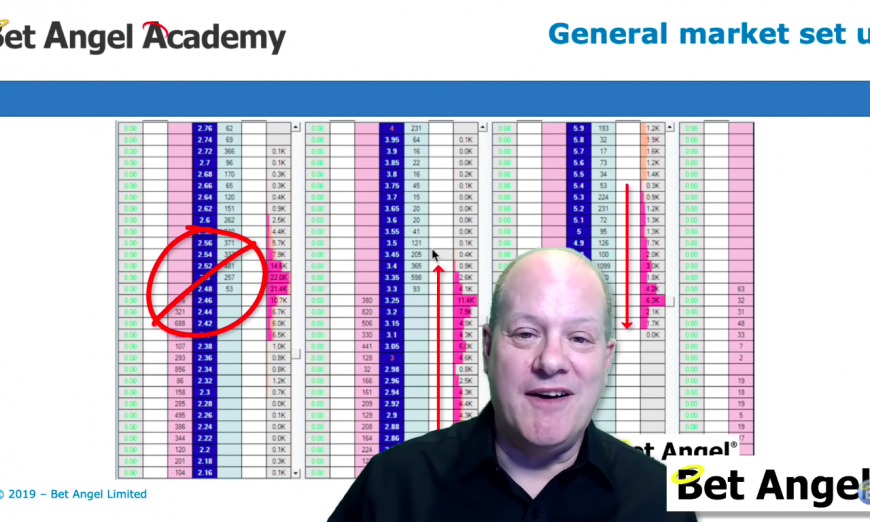

So let’s look at a simple strategy. We are going to be look at finding a steamer, something that’s being heavily backed within a particular market.

In the next article in this series, we are going to find our entry point.