This article is one of two in this series. To visit part two click on this link

A common question that pops up regularly in support, the forum or my inbox, is about Betfair’s premium charge. It’s a charge than only appears in the online betting world on betting exchanges. It’s a bit of a weighty topic so I’ve broken it down into two posts. The first explores what it is, the second whether you have any fear of paying it.

There are a lot of people out there who discuss premium charges but are clearly not affected by it. So in these two articles, I aim to give it a bit more depth and explain its application.

The first post also focuses on the history and origin of the premium charge and whether a ‘special deal’ on commission on Betfair is actually so ‘special’. The second will narrow in on whether you would actually ever qualify to pay it. It’s a complex topic, but one that requires some in-depth discussion.

What is The Betfair Premium Charge?

For those who want a basic definition of premium charge, it is a charge that’s levied on ‘elite’ participants weekly profit on the Betfair exchange. I use those words very carefully because lots of people have reacted negatively to premium charge, but in fact, it only affects a small number of people. This is because there are three hurdles you need to jump over to attract the charge. When multiplied together each component reduces your chance of being affected.

There are several hurdles to overcome, such as your commission generated, total charges and what you have earned over the lifetime of your account. But we will cover the next blog post. If you don’t see the label, ‘Premium charge’ in your account section, then you are not near it and don’t have to pay.

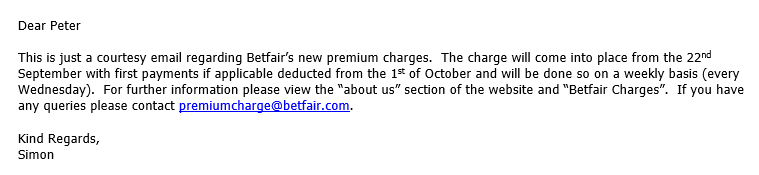

As somebody who joined Betfair right at the start, I qualified to pay the premium charge when it was first introduced in 2008. It was set at 20% of net profits and I received confirmation of the charge by email. No phone call or explanation, just a generic email appeared into my inbox. It was probably not the best way to communicate that to affected customers!

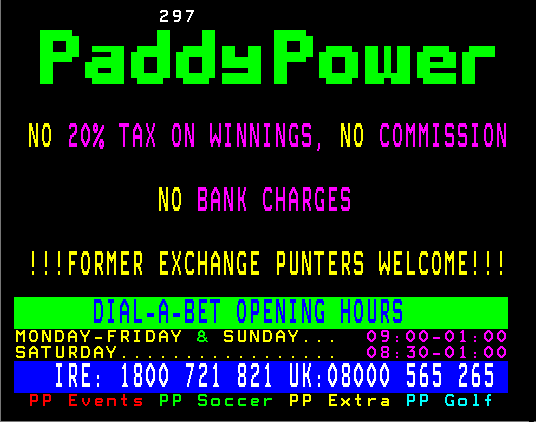

The, then independent Paddy Power, thought it would be funny to highlight just what impact this would have on punters using an exchange. Probably the main objective was to confuse punters and, ironically, put them off using an exchange. Betfair decided to counter with ‘clarification’ to their customer database. It laid out how few people would actually pay it, but the negative damage was already done and competitors feasted on it.

Then it went pretty quiet for a period thereafter, but it returned with vengeance in 2011 when Betfair increased the charge again the most successful customers.

Through my journey of understanding the premium charge, my objective was to fully understand the reasons behind it and several coincidences have occurred that have allowed me to get a really deep understanding of why it’s in place, the people it affects and how many of them are impacted by this charge.

Why does the premium charge exist?

Instead of focusing more on the history or the emotive side of the charge, we’re going to look at the summary of reasons why it is said that the charge exists. To have an understanding of why the charge is is enforced you have to explore the structural issue that is apparent because of the way that exchanges work.

It’s easy to slip into the mode of saying that the premium charge was introduced for commercial reasons. It not doubt would have a very beneficial effect on the bottom line of anybody introducing it, but lets dig deeper.

When exchanges were first created they were designed to be better places for gamblers to work, but when people started trading on exchanges. It created a structural imbalance in terms of the way that the market works. Therefore, if you want to understand the reasons put forward by all exchanges, that is the main reason. I’ve seen the numbers and there is an imbalance, it also exists at bookmakers.

Interestingly, other exchanges such as Matchbook and Smarkets have modified their terms and conditions to allow a charge like this to be in place. They held off for a long time but the fact it’s become a standard term implies there is a structural issue beyond what I can explain in this one blog post.

Overall the charge only applies to a small section of the ecosystem within the exchange. I’m not going to be an apologist for it because I obviously have paid significant sums of it! But we will leave that for another discussion in the future.

Trader vs Gambler commission – Who is better off?

The best way to look at premium charge and why it exists is to look at the traditional gambler and to look at a trader. However, it is not as black and white as it seems, as more often then not special deals are also thrown in the mix. In reality, when looking into the true structure of what the special deals are, it reveals the difference between gambling and trading and it also reveals that it is not actually much different from paying the premium charge.

Using spreadsheet examples I will guide you through how the charge exists, how it’s balanced and what it looks like if you apply a special deal. This is in a simplified form and the actual calculation will be slightly different. This could be on any market such as horse racing, the underlying market is not important when doing this calculation.

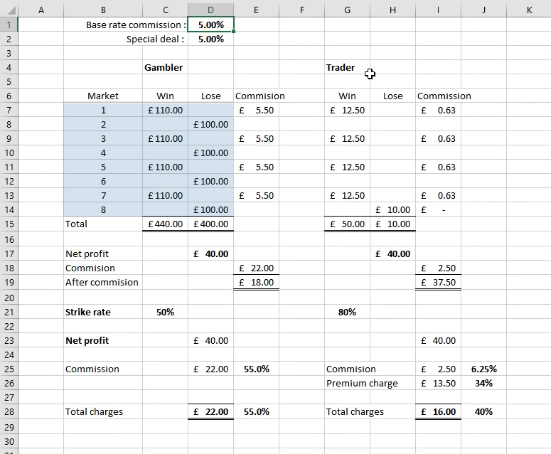

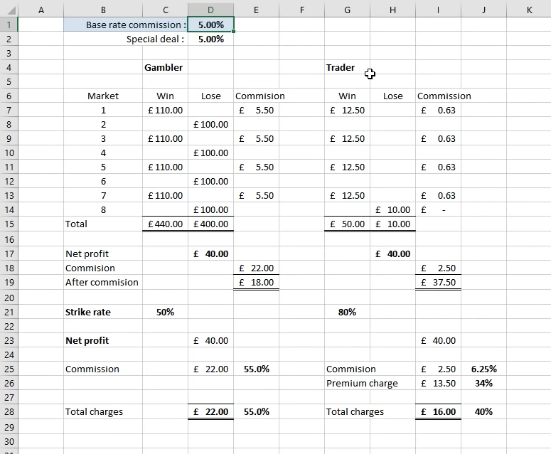

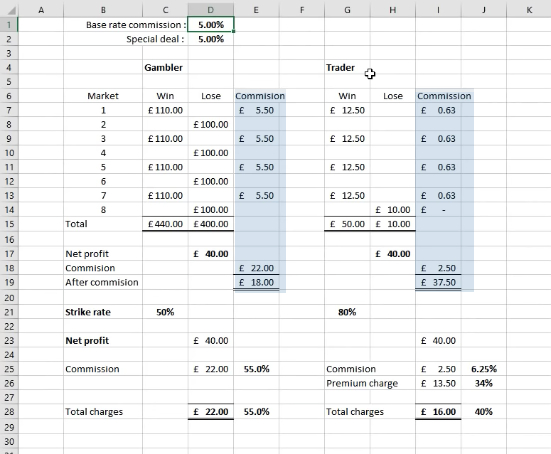

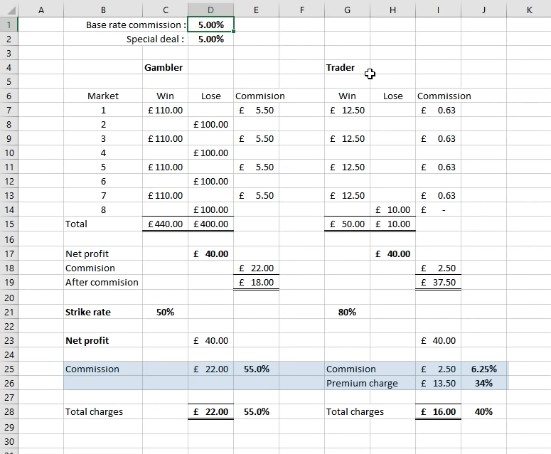

So, first of all, I have set the commission to exactly the same, 5% which highlighted in the image below*. Betfair naturally has a base rate commission that varies. But for this example, we are keeping it simple with 5%. I’m not going to attempt to discuss the an implied commission, I’m not going to look in-depth at the specifics and variations within the calculations as we’re just going to have a plain vanilla look at how all of this works.

To begin, we have to understand that the base rate is what you pay when you actively bet or trade in a market on an exchange. In my example I am comparing the gambler, shown in the left-hand column and the trader on the right, to display how the charge affects both users.

In this example we have traded eight markets or we bet on eight markets in total. Now the gambler is going to win or lose large amounts of money, that’s the basics of gambling! The difference between gambling and trading is if you put a hundred down you want to win 100 back but you could lose 100, however when you’re trading putting the 100 down could win 10 or you could lose 10.

Equally, if you’ve got no discipline you could win 10 and then lose a hundred, but in all intents and purposes, when you’re trading you’re going to win a percentage of your bank.

So you can see highlighted in the image below that the gambler wins £110 pound on the first market that they actively bet on, then they lose 100 on the next. Then they win £110 and they lose 100, win 100, 110 lose etc.. So overall in all of these eight markets that they’ve been active on they’ve won £440, but they lost 400 leaving them with a net profit of £40.

Comparatively, the trader has also made £40, but of course they’re working in a different manner than traditional gambling. Trading is gambling, it’s just doing it a different way. If you look at the highlighted area in the image below you can see that rather than winning 110 and then losing 100 we are saying that when they win they win £12.50 because they’re trading the price movement (gambling on the price movement), not gambling on the outright result.

So you can see here that when they win they win much less, but generally their strike rate will be higher. For the gambler, the strike rate is 50/50. They’re winning and they’re losing in roughly equal rates but they’re winning slightly more than they’re losing and that’s how they’re making their profit. The strike rate for a trader will always be much higher.

The offset strike rate for the trader is at 80% and four times out five they’ve won £12.50. However, the last trade goes through and they mess it up loosing £10. We’ve got four lots of £12.50, making £50 falling to £40 after their loss of £10 on the last market. This is pretty much what gambling and trading will look like on a betting exchange.

Why Betfair trading is better than gambling

This is why trading is such a great way of participating in gambling markets.

The amount of commission that you pay on your overall trade is based upon your net profits and not based upon your stake plus the return. Unlike what happens when you’re gambling, the commission when Betfair trading is on the amount of profit that you make in that particular market at that moment in time. That’s why trading has been so brilliant because you only pay if you profit, whereas in gambling you’re paying on open-ended risk.

So they’ve both made £40 in very different ways. They’re both realistic simulations of how either style works. However, you can basically see that they’ve ended up with a profit of £40.

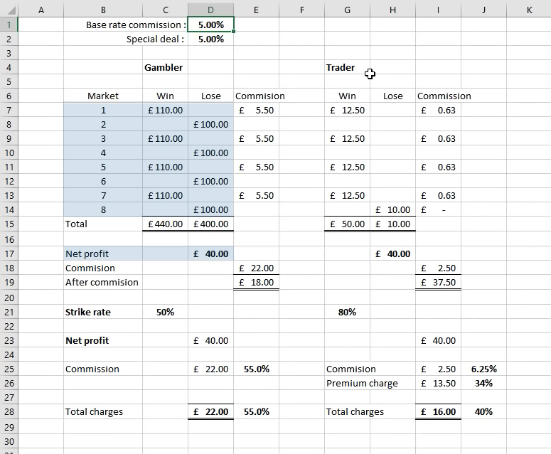

So let’s look at the commission that was charged with using a base rate of 5%. You can see that the commission has added up to £22, meaning 5% of £110 pounds is £5.50 which occurred four times sub-totalling £22. After commission that £40 turns into £18 of profit, the gambler has lost most of their profit in commission which that goes to the house (effectively the betting exchange.)

In comparison, if we look at the trader who had also made £40 over this period and we have also paid five per cent commission. However, you can see that this just adds up to £2.50. So we retain most of the profit within the market, making trading much more efficient in terms of squeezing a profit out of a market – higher strike rate, lower commission.

So we’ve examined the strike rates here and we already know that the net profit is £40 on each, but this is where everything begins to diverge…

Why Gambling tends to lead to more losses

The commission that was paid by the person that was gambling is effectively 55% of their total return. More than half of the amount of money that they made through being able to make decent selections, has ended up in the pockets of the exchange. However when you’re actively trading, obviously your commission is much lower so you can see in the image below that we’ve ended up with a commission of 6.25%.

Gamblers on a betting exchange pay much more commission than a profitable trader. Most money in any market is lost in frictional costs, another word for charges. Gamblers pay much higher costs than a trader and therefore their edge needs to be very wide to cover these costs. A trader can work on wafer-thin margins.

We’ve only paid £2.50 on £40 displaying a significant mismatch between the two. This is why from a betting or sportsbook perspective, gamblers are welcomed with open arms. This is generally because they tend to lose money or pay very high rates of commission with respect to their total return. If you look at traders the amount of commission that they paid is quite small in comparison to the amount that’s generated by your traditional gambler.

Where does the premium charge come in?

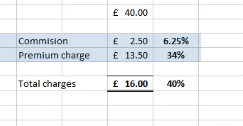

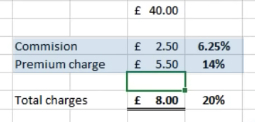

So the premium charge was introduced to restore the imbalance between these two types of users. It was more or less an attempt to align business models if the positioning is to be believed. If we top up the premium charge on the trading side of things up to 40% then there would be an additional charge of £13.50 on top of the amount of commission that has been paid already.

Now if we modify this and change the rates to 20% then you can still see that even if the trader’s paying a premium charge at 20% there’s still a massive gap between that and the person that is actively gambling. But it’s a bit nearer.

This is a structural gap that occurs within the betting exchange markets. Looking in retrospect, when the exchanges were created, they probably didn’t expect people to actively trade. If they would have figured out exactly how everything would develop from there, they may have put a slightly different charging structure in place straight away.

The difference between paying a commission on a bet and the amount of money that you could possibly earn through betting is vastly different from the amount that you would make through trading on those actual bets.

Obviously, there was a commercial opportunity for the exchanges on the small number of people affected. But ultimately, whether you like it or not, the betting exchange model does suffer from a structural imbalance.

Special Deals or not so special?

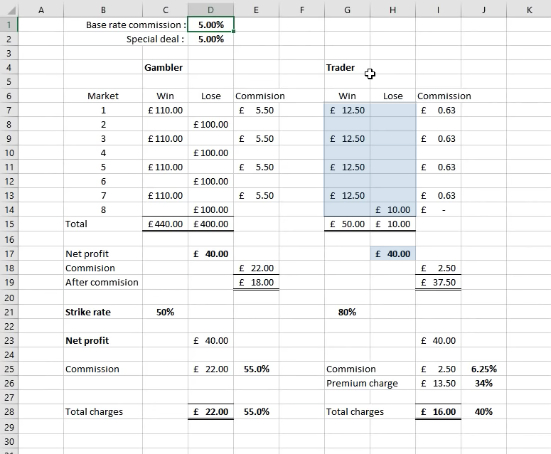

Earlier on in this article, I mentioned special deals. There has been some discussion around people getting ‘special deals’, but whether a deal is ‘special’ or not all depends upon what your strike rate is! If you win and lose a lot relatively frequently, then your overall commission that you pay is going to be quite high in comparison to the amount of profit that you make.

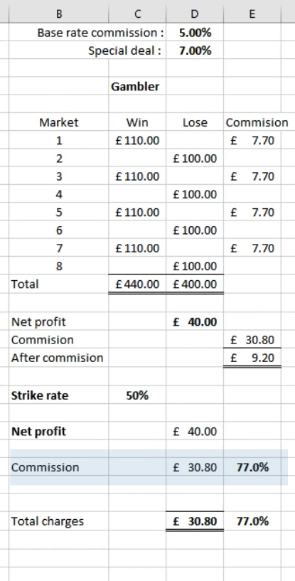

So how would a special deal work? Let’s say that you’re paying premium charge and you’re paying at it a fair old whack. You’re on a 40% commission rate band and someone from Betfair comes along and says:

“I’ll tell you what, we’re going to fix your commission at 7 %. So you can have 7% on every single correct trade/bet that you put through the market, but we’ll drop your premium charge completely, all you’ll do is pay a higher level of base rate in commission! “

– figurative betfair!

Let’s suppose that 7% in instead of 5% and we assume that the strike rate remains the same for the gambler/trader that is taking advantage of this particular deal. Can you see that the amount of commission that the gambler is paying against the amount of profit that they make absolutely skyrockets.

So if they were 5%, the standard base rate in the previous examples, you can see them paying 55%. If we dropped them to 4% they’re paying 44%, but if we bumped them up to 6% they’re suddenly paying an absolute fortune of 66%.

It’s not really applicable to the trader because their commission rate is going to already be low meaning that will be topped up by premium charge. However, if somebody has a high rate of commission that they’re paying already at a fixed deal of 6% for an example, paying a premium charge of 40% sounds like an absolutely fantastic deal, but it’s not…

Why? It’s all about the strike rates!

A fixed-rate for those who have a lower strike rate is a poor deal. If your strike rate is on a higher scale than a fixed rate deal is excellent! But sadly the evidence proves that the likelihood of you getting a fixed rate is generally only for those with low strike rates. For example, if I was offered I fix rate I’d probably take it due to the structure of my account, but it is dependant on strike rates.

So if you don’t understand what the premium charge is and would like more detail or some of the discussion around it, don’t worry about that because I will cover in a future blog post! This blog post is really for people who have some sort of a vague understanding of premium charge, but want to understand why it’s in place. I hope it gave you some more context on this subject.

In the next article, we will look at whether you ever could fall into its grasp.