On Tuesday the 5th of May a mammoth betting conglomerate was formally created. What will be the impact on the industry?

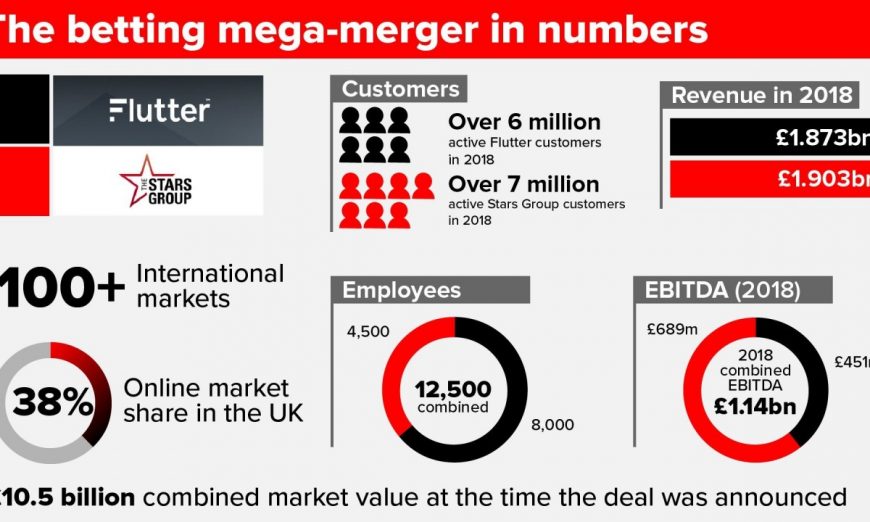

The merger of Flutter PLC, the owner of Paddy Power and Betfair, with the Stars Group, a Canadian operator that bought Sky bet in 2018, was proposed last year. It was cleared by the competition commission and formally ratified by on Tuesday.

To learn more about Flutter PLC and it’s background follow this link: –

https://www.flutter.com/investors

To learn more about Starts Group and it’s background follow this link: –

https://www.starsgroup.com/the-stars-group/financial-and-corporate-information

According to industry figures, published in the Racing Post, the combined revenue of the group will be £3.8bn. By combining certain operations the group estimate it will save them £140m in costs. But more importantly, they will become an absolutely massive gambling group with a far reach across multiple territories in the world.

Both sides have stated that they’re quite keen to see geographic expansion in the US and in other territories. So they are looking to cut costs, but also grow market share. The combined group will have a market share of about 38% in the U.K. and it’s a surprise to see the Competition Commission allowing a merger on this scale. Especially when you consider they’ve blocked many smaller mergers in different industries.

Are Bet365 worried?

The merger probably strikes fear into Bet365 the most. Last year, Bet365 announced revenue nearing £3 billion. So when you look at that against the combined Flutter group, you can see that they’re fairly close. This obviously a played a part in this merger, to get on par with somebody like Bet365.

From a strategic perspective, mergers are classic corporate games.

It’s a quick way of reaching scale. But I do question in the betting industry whether the scale is as important as you would think? A lot of the revenue that these companies are generated nowadays, as Bet365 has shown, online. Of course, in general terms, a website can be replicated across the world quite easily with relatively few staff and therefore becomes more of a marketing issue rather than one of scale.

Mergers and scale

Traditional companies tend to look at scales of economy to achieve a number of cost savings. But I’m just not sure that this is necessarily a strong case when you’re looking at something that’s run as a website?

Of course, the Flutter business is quite complicated now because they have a combination of Web sites, different brands and betting shops.

I would have thought it would have made more sense to create a giant betting company based around a brand of websites, rather than having bricks and mortar included into the mix as well. You do wonder what’s going to happen to betting shops over time, especially when they have fallen out of favour with the legislators. The ease and constant access to online gambling is so prevalent nowadays.

On the broader basis of mergers, I’ve always been a little bit sceptical, but that is because of my past experience working for merged companies. It’s about the only time in the world where one plus one equals one and a half.

As companies merge, they begin to find synergies and therefore start to strip out costs that are duplicated across organizations without particularly taking into account why some of these things are in place. They are often legacy issues that create additional structure within a company. Things happen to make sure that the company function and when you strip it out as things no longer function the way that they intend.

Again, this would be a little bit easier if you decided to have Web sites that would merge and achieve a greater reach through the brand. But when you have companies that are very different, it’s a little bit harder to make that work for you and cost savings never really come, but as management has committed to them, they try and make them work. Even if it makes no sense.

My experience of mergers

My experience with mergers in the past is that not only do you get a misalignment in terms of the way that companies function and sometimes that indirectly affects the way that the business is run. But also you tend to find that if you’re a small part of a larger organisation, then you tend to get forgotten. The corporate goal overrides any individual business sense that can occur within a division.

My experience of this was working for a niche of a larger business. I was brought in several times in my career to work with and promote a product line within a larger corporate. But the issue that I always faced was that the corporation wasn’t flexible enough or wouldn’t understand well enough exactly what I was trying to do. I always had to fit in around the corporation rather than fit in around the needs of the individual business within which I was working.

As a consequence, you were given an objective and target that were no longer able to reach because the larger corporation wouldn’t flex to your needs and those of your customers. But it was always the corporation that would win out. As a consequence, it was always a bit of an uphill struggle. I always argued for my own business unit, my own accountability for profit and loss, and the ability to make my own decisions.

But never got it in my ‘normal’ career. Which was more or less the reason I left a normal career.

Paddy Power & Betfair merger

When Paddy Power merged with Betfair. They initiated a one account project where they decided to merge some of the infrastructure to run on the same system. The same thing happened with the Betfair website so that the architecture would flow through the organisation.

That creates problems in terms of how that is managed, but also in terms of the business priorities within each of those divisions, it’s very difficult to unravel something once you’ve started to tie it up in knots. You get unintended consequences as well and you can see this in some of the post-merger activity that has taken place with the Betfair exchange when Paddy Power merged with Betfair.

Betfair had a strong account presence in Canada, it was a sort of backdoor to the US market. When the merger between Betfair and Paddy Power occurred, it resulted in the exchange being pulled from the Canadian market. Paddy Power had incumbent business in the market and that meant it was cheaper and less controversial to bin the betting exchange.

No sooner had this merger completed than Betfair, on the exchange side, also pulled out of another couple of markets, most notably on this occasion Russia and Estonia. And this was no doubt due to existing commitments or situations that would not sit nicely within the larger corporate group.

Betting exchanges offer a better solution

Therefore, I always view mergers and the like slightly negatively, as it’s the same issue I face all those years ago.

A betting exchange is a betting exchange and should live and die by that fact. Chuck it into a corporate structure and you lose the disruptive effect and incentive to transform things. My view always has and always will be that betting exchanges are a great way of doing business in betting markets for punters and all parties.

I understand that they don’t serve some of the customers as well as they could do but there are plenty of solutions to that. It’s just that the industry has chosen not to pursue them!

People like to win, but not in the long term

Ultimately one thing that this has exposed is that people just like to have a bet and they like to win. There’s no concept of value or anything beyond that. I always knew that was the case, but nonetheless, I would have thought that one company or another would have risen to the challenge to show people why betting exchanges were much better.

You also address all those negative stories about the gambling industry related to being restricted, banned, failure to pay out and palpable errors. These are solved by betting exchanges, none of them should exist. Some of the negative connotations of betting, including things like money laundering, integrity. All of these things are very easy to manage and on a much better level with a betting exchange.

The best thing about the exchanges from a problem gambling perspective, it’s that is easier to manage and the tiny book overround means people lose less money on them than betting with a traditional sportsbook.

You always see people moaning about all of the problems related to the betting industry, but nobody turns around and says, you know what? Why don’t you use an exchange? If more people did that then maybe betting exchanges would gain the traction they deserve?

How will the industry evolve from here?

Now, I’m being slightly negative here, but the fact is betting exchanges are a better model and they are here to stay.

But I’ve always felt that there is the opportunity for somebody to really aggressively pursue the exchange model, as it’s never reached its full potential. I think it is ripe for a bit of investment and for somebody to really take the bull by the horns. But how that happens and with whom, I have no idea! Maybe the existing incumbents will surprise me?

I think you could view the merger as a necessary part of the evolution of the industry.

Some of the players out there are getting extremely big. Whether you loke them or not, Bet365 have done a fantastic job of growing organically. So much so, that companies are beginning to have to merge in order to reach the same levels that Bet365 have reached. Getting there organically just isn’t going to happen.

However, in terms of the Betfair exchange, it becomes a much smaller part of a much bigger wheel. I think geographic expansion, especially in key markets like the US is probably further from reach at the moment. All that we can hope for is that the focus and desire that the exchange deserves, which its founders gave it when it was born in the year 2000, is retained within the company somehow and put in the hands of capable individuals who can continue to grow the business.

Let’s hope that that is the case.

“…but the fact is betting exchanges are a better model and they are here to stay.

But I’ve always felt that there is the opportunity for somebody to really aggressively pursue the exchange model, as it’s never reached its full potential.”

Hope you are right 🤞🤞🤞