When you’ve been betting profitably over a large number of years, across an even bigger number of events, naturally the most common question I get is – what’s the big secret?

Over my many years of trading, I have found a number of key facets that are fundamental to being able to bet profitably over the long term. However, this is often something that a lot of people just can’t do! Not because they can’t, but because they won’t.

It takes a certain approach to be able to do this correctly and a lot of people do not get over all of those hurdles to be able to do it – will you be able to do it?

What you first need to understand

Before we go into that, I need to prove one of these key concepts to you. If you look at my social media, I will often make suggestions and little hints about things that I think of value or not value, because ultimately that’s how you’ll make money in the long term by betting on various sports. If you can find value, you will make money.

So what is the most common hint I offer? Well one of the most common phrases that you see me post has become a bit of a catch phrase for me…

What I’m hinting at here is that strange things occur more frequently than you would expect, and that’s where you tend to find value.

People love to win!

Typically when you look at any particular betting market a simple problem always comes to the surface, people love to win. People tend to bet on things that are very likely to occur.

Why? Because you’ll get a little kick from getting that win and when we look at tipsters and ‘experts’ those frequent wins will hold you in the game for longer, so you give them more of your money, clicks views or however they profit from your interest!

I approached a couple of people to write an article about how I profited at the Cheltenham festival. After all, I’ve won 55 out of the last 56 races at Cheltenham and that must be interesting for people to know how I did that.

Ultimately no article appeared about how I won because I refused to produce what these publications wanted. What did all of these people want?

Unpleasant truths

They just wanted tips! Which horse is going to win? How is it going to win? How can I profit from it? I get it, of course, everyone wants to find the hack to endless profits it’s ingrained into the human psyche!

If you write an article saying, ‘Back this at Cheltenham’ it gets attention and people follow it. Anything about that isn’t immediate enough in today’s world.

But of course, it’s a lie. It’s never that simple and the nuances of doing this professional are much more complex.

Another element of the betting scene that is something that occurs, again and again, is everyone’s love for the favourite.

Everyone loves a favourite… right?

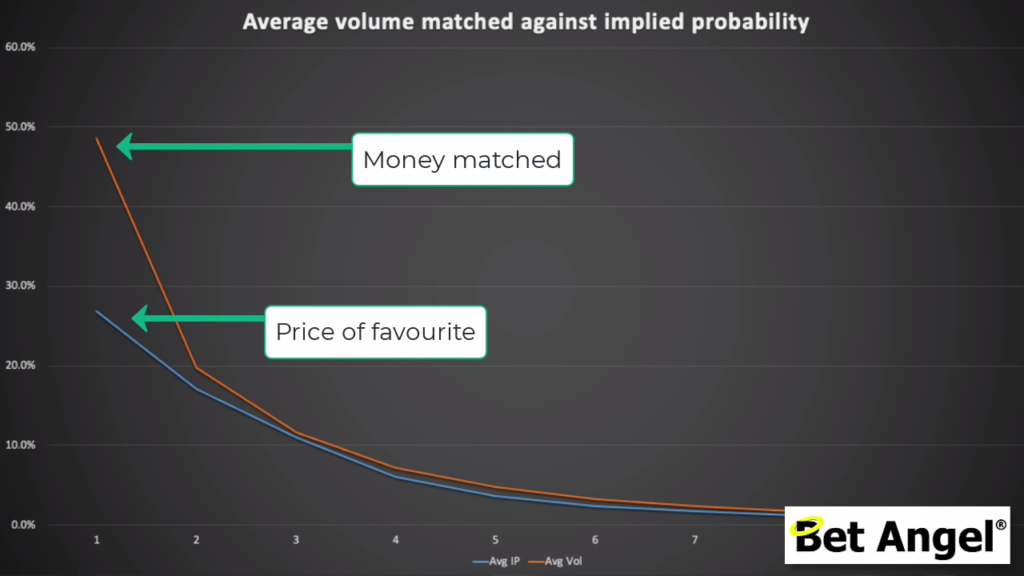

To explore this, let’s look at this graph which describes how much money is bet on the favourite horse. You can see that if we look at the price there’s much more money goes on the favourite than it does on any other runner in the field.

So do you think that betting on a favourite, especially at a shorter price, is a good proposition or a bad proposition?

We know that the market is generally efficient overall, but that efficiency is made up of some things being efficient and other things not being efficient. If you measure all of those in aggregate, of course, that’s going to be efficient because you’ve got bad guesses and good guesses which will balance out the whole mix.

However, on an individual basis, you will find that there are discrepancies all over the place. It’s those discrepancies that I tend to look for within a market.

So if you’re betting on a favourite, the first thing you need to know is that there is a lot more money betting on the favourite than anything else. The shorter the price gets, the more money is bet on it.

The silly thing is, the shorter the odds get, the less return you will get on it. So the shorter the price goes, the more and more confident people feel that it’s going to win, but the poorer value it becomes. Price is what you pay, value is what you get.

So what’s the alternative?

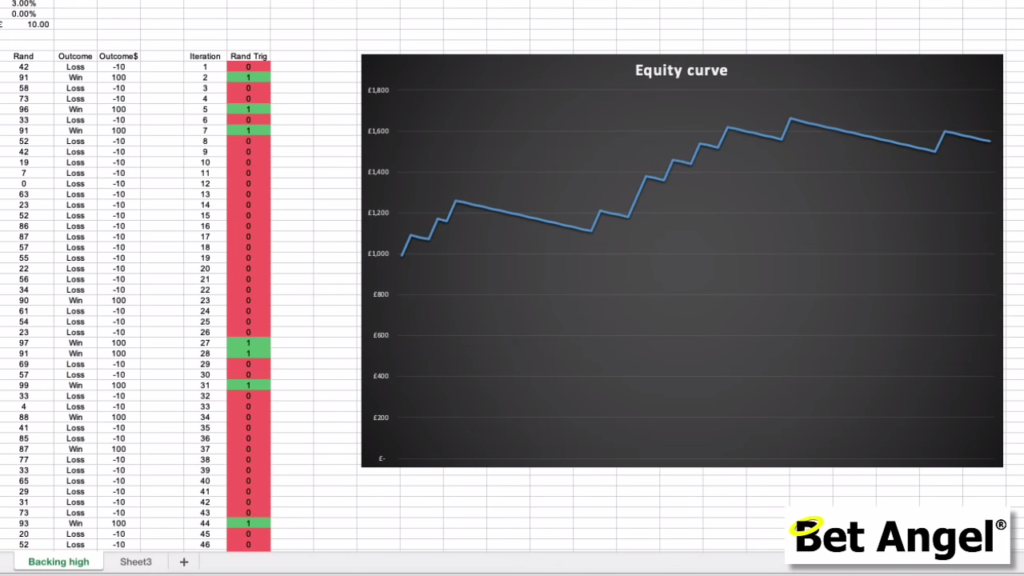

Well, it is sort of as simple as betting on an outsider! When you bet on something at a short price you’ll receive a few hits every now and again, but you’ll win quite frequently. If you look at outsiders, it tends to go the other way round.

So you’ll get a loss after loss after loss with a win thrown in there once in a while. The problem is it’s very hard to back outsiders over a very long sequence of time because you need a bigger bank than if you were pursuing a strategy that won frequently. You also need the mindset to be able to tolerate a string of losses.

A strategy that wins frequently often also slowly drains away your bank. So while winning frequently feels nice, it often isn’t the way to go.

Winning frequently makes you look a genius, backing a string of losers an idiot. That’s ultimately why people like to win frequently.

Backing Outsiders

However, when you’re backing outsiders, you tend to find it drains very quickly but then gets a nice top-up. What you’re looking to find is to find situations where you could actually get a little bit of an edge.

The curious thing about the market is people don’t bet on the outsiders as much as they do on the favourite. The fact is, on a betting exchange where the market is so efficient. If the favourite is pulling in, by default the prices on the others will start to go out.

Whether the price is pushing out naturally or whether it’s a function of the fact that the front of the field is a little bit too short. It tends to push the value to the back of the field.

Now if you go and back something in the back of the field, you’re probably more likely to find value, but you need to adjust your stakes in proportion to the potential return. So what does that mean?

Taking advantage of that underdog

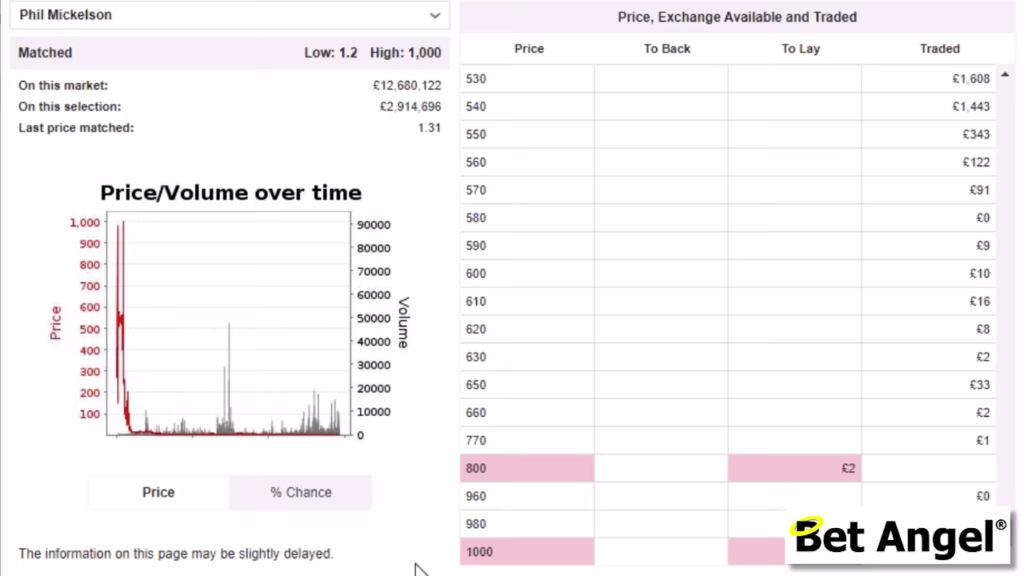

On the US PGA Golf recently, 50-year-old Phil Mickelson made history by becoming the oldest player ever to win a golf major. He did so at odds of 500/1.

You’re probably thinking, who would have backed Phil Mickelson at 500/1…?

Well… I did!

The interesting thing is I’m looking for value all over the market. When you look at a golf event, the problem that you’ve got is picking up a 500/1, you’d have to bet in a lot of golf events for that return to be able to be seen. So what I don’t tend to do is back just one player, I back a series of them that I think will be in contention at one point or another.

Putting all your eggs in different baskets doesn’t guarantee profit

It doesn’t need to be just one, it could actually be a mixture of those. If you use Bet Angel you would use a tool like Ducthing to set a potential stake or potential profit that you’re aiming for and then spread that liability across a series of events, players, horses, whatever you want.

The problem is that you will lose fairly frequent frequently before those outside events occur. Sometimes the payoff can be absolutely spectacular, but sometimes it’s a bit more moderate.

The fact is that they occur much more frequently than you would expect.

What are the odds of an outsider happening?

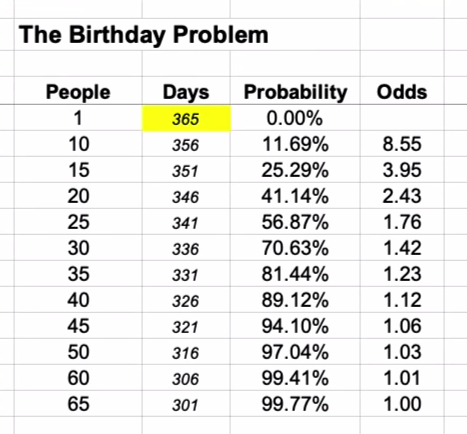

Let me give you an analogy. If you look at the number of days in a year, you will know that that is approximately 365. So if I’m in a room and somebody else walks into the room, what’s the chance of us having the same birthday?

Well, to figure this out we need to look at the birthday problem. It’s a well-known piece of maths to do with converse probability, but it always catches people out.

When you look at a room of people, you just wouldn’t expect somebody in there to have the same birthday as you. You would think you’d need at least 365 people before there’s a good chance that two of us had the same birthday.

Well, the answer is that you only need 23 people in a room before two or more people share the same birthday. It seems ridiculous, but if we actually look at the statistics here, you can see as we increase the number of people within the room and the chance, the likelihood of them having the same birthday increases almost exponentially.

It becomes a very heavy odds on even if you increase the numbers to a relatively small amount. This really demonstrates how unusual events occur more frequently than you would expect.

Counting on people being wrong

Now in the context of betting, we have to look at this slightly differently but the fact is that people get the probabilities wrong all of the time. This is where you tend to find value at some of those bigger ends of the market.

Additionally, you can also find value simply because people just don’t bet there. They don’t have the bankroll, the psychology to do it or they just can’t stand the drawdowns. You could also risk looking like a complete idiot when you have a long sequence of losing bets on bets that are ‘obviously’ going to lose.

The fact is that people’s desire to take the easy route tends to lead outsiders, or outside events, generating more value within the market.

So if you want to profit from betting in the long term, my advice to you is always to look for those outside events. Structure your staking in such a way that you can moderate the payoff or the amount of money that you’re using per bet. Then finally, if you can keep your bank going for long enough, those payoffs will occur much more frequently than you would expect.

Ultimately, that’s where you’ll find the most value in the market. So if you want to make betting pay and the long term, that’s exactly what I recommend you do.

Love this article/video, my favourite of the lot.

Although, wouldn’t premium charge wipe out the long terms profits if you’re at this level as this is taken weekly?

Premium charges are only on profits, and even then you have a large number of hurdles to start paying them. If you start now, you can probably avoid it altogether.

10/65

enjoyed that peter .thank you

Many thanks for your comment.

Hi Peter,

in this article you mean a simple betting? (not trading)

i downloaded the last 3 years of data from betfair which contains the main information about the races (winner, BSP, Inplay High / low odds, racing lenght etc.). I created a big excel file with filters, for simple BACK / LAY betting at BSP. But I didn’t find a profitable setting, even in the high odds range. I also counted on the betfair commission, which takes a surprising amount of money, often turning a profit at a loss. I tried a lot of settings but eventually gave up.

Or are you thinking of something more complicated than just betting at the beginning of a race?

If you measure any data in aggregate it’s always going to be ‘efficient’ as you measure the entire market, which has to balance out by default. It’s impossible for it to do otherwise.

So the trick is to be selective and look in the market where errors are more likely to occur and be specific to those situations.

I can show the market is perfectly efficient. But over 20 years of making money from these markets tells you that it can’t be efficient.

This goes completely against the longshot favorite bias which exactly makes the opposite conclusion of what you just did here. You have any data to support this idea that backing underdogs would be profitable? It should be the heavy favorites that are underpriced.