We are pleased to announce that a new beta version of Bet Angel Professional is available v1.47.0

Download it from here: – https://www.betangel.com/securedownload … _beta1.exe

Following feedback from our community this version sees:

- the introduction of Staking Methods

- the option to calculate Offsets (and Stop Losses) by Percentage instead of ticks.

- for Advanced Automation users, the ability to quickly Copy Rules between Automation Files.

Staking method

Bet Angel can now vary stake based on the placement price of a bet rather than just auto-stake using the best market price.

There are options to use a fixed stake or to calculate the size of the bet on the fly based on liability, book%, and tick size. Rather than update the on-screen stake using auto-stake, the stake you enter (ladder, one-click etc.) provides Bet Angel with your ‘seed stake’. The seed stake in conjunction with the staking method and the price of the bet will determine the actual stake to be used.

e.g. Enter a lay stake of £10 and select a ‘Liability’ Staking Method to ensure that any bet you offer to the market will have a liability of £10. So even if the current best price is 3.0, you can lay at 2.6 and a stake of £6.25 will be used. Lay at 1.8 and a stake of £12.50 will be used. In each case your liability will be the same as the £10 seed stake you’ve entered. This is particularly useful for in-play betting with its volatile price movement.

‘Staking Method’ has replaced the ‘Auto Stake’ area in the header of the main trading screen. We have however retained the original ‘Auto Stake’ option (now legacy) for those who still wish to use it. To revert to this view, click on: Settings > Edit Settings > Staking and select which option you prefer to use.

The Staking Methods explained

Fixed Stake

This is the regular way of staking – the stake you enter on-screen will be used when placing the bet regardless of the price.

By Liability (Lay Only)

The ‘Seed Stake’ you have entered (or in the case of the Ladder, selected from the Standard or Preset area) now becomes the liability you are willing to accept on lay bets. So, if you have selected a £20 stake and place a lay bet at odds of 3.5, Bet Angel will calculate the amount needed to realise a £20 liability; at odds of 3.5 it would mean a lay bet of £8.00 is submitted to the market. This means if that selection loses you make a profit of £8.00 and if it wins you lose £20. Note: When using this ‘Lay Only’ method, back bets behave the same as when using a ‘fixed stake’ so your risk in the market will be the same £20 regardless of whether backing or laying.

By Liability (Back & Lay Bets)

This option is most useful when you wish to trade by liability. Your back bets are staked in a similar way to the lay bets so that positions in the market can be easily opened and closed. In the case of a back bet, the ‘Seed Stake’ will now be your potential profit (the liability the person who takes your bet is accepting) so if you have selected a £20 stake and place a back bet at odds of 8.0 Bet Angel will calculate the amount required to realise a £20 profit; at odds of 8.0 it would mean a back bet of £2.86 is submitted to the market. This means if that selection wins you make a profit of £20 or a loss of -£2.86 if it loses.

By Book%

The ‘Seed Stake’ is divided by the placement price of the bet (the amount placed would be the same regardless of backing or laying). So, if you have selected a £20 stake and place a bet at odds of 5.0 the amount submitted would be £4 (£20 / 5.0 = £4) and if the same £20 stake was used to place a bet at odds of 2.2 the amount submitted would be £9.09 (£20 / 2.2 = £9.09).

By Tick Size

Your ‘Seed Stake’ defines the profit or loss that you wish to make for each price tick the selection moves (before greening), this would be the same regardless of backing or laying. e.g. If the seed stake is £10 and a bet is placed at 4.2, then a £100 bet would be submitted (due to tick increments of 0.1 at this price; 0.1 multiplied by £100 being the £10 seed stake you’ve requested) .

Offset and Stop Losses by Percentage

You now have the option to place offsets and stop losses a defined percentage away from the opening bet. In the global settings area (top area of the main trading screen) a small drop down box has been added for you to select between using either ticks or Percentages next to the original ‘offset’ box.

You can also use the global settings editor to save some named global settings presets using either percentages or ticks.

These same options are also available when using Advanced Automation and can be found in the ‘global settings’ area on the ‘parameters’ tab within the Automation Rules Editor. Also, added to the parameters tab of the Automation Rules Editor are several additional options to ‘place bets at’ custom percentages above and below best market prices or SP.

Percentage Offsetting and Stops are now also supported in Excel – see the templates for the syntax.

The ‘custom column editor’ of the one-click screen has also been enhanced – it’s now possible to create custom buttons to place bets at a defined percentage away from the current best market prices.

We had requests to calculate percentages based on the price and also the (price – 1.0), so both calculation options are supported and your preference can be selected on the Bet Angel Settings screen.

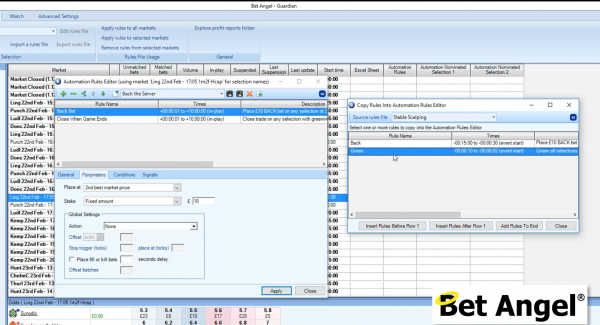

Copy Rules between Automation Files

As the complexity of Automation Rules increase, in can be handy to reuse existing rules. e.g. Perhaps you have a tried and tested process to exit the market and green-up

It’s now possible to quickly and easily copy rules (and all associated parameters and conditions) from another one of your automation files.

Within the Automation Rules Editor an icon has been added to the toolbar, when clicked this will launch a 2nd rules window where you can select rule(s) from any of your existing automation files and copy across directly into your current file.

Enjoy!