Scalping is

I thought it would be interesting to revisit this topic, as scalping is a trading strategy that is so popular. In this article, we will cover what you can do within larger race markets and typically what your real objective is when scalping – it’s generally

So if you fancy yourself as a bit of a Betfair scalper, read on…..

Betfair scalping is born

Scalping has been around since the start of trading on Betfair and scalping on Betfair can be done in a number of markets and in a number of ways. For the purposes of this article though, we will focus on horse racing markets.

I started ‘accidentally’ started scalping. My introduction to Betfair was

I sort of guessed that others may have discovered this. I wasn’t aware of anybody, so didn’t really talk about it. But as a Betfair trading strategy, it was popularised when Adam Todd published some videos showing him scalping the markets.

By then, the markets had already started to change from the early ‘printing money’ days. Perhaps it was the popularity, the publicity or just the general growth in the market. But it was obvious from my early attempts that while some markets suited this strategy well. Others clearly did not.

What exactly is scalping?

The problem is with scalping is that you could define it in a number of different ways. I’ve seen many arguments on what scalping is or isn’t and its exact definition as a strategy. If you are a native American then it would also mean something completely different!

A few years ago somebody ‘challenged’ me to prove that scalping still worked. So I went off and scalped for a day, which isn’t an optimal strategy by the way. Only when I published the results, was I informed that I didn’t meet the exacting criteria that this person felt defined the process of scalping! So I succeed or didn’t according to how you defined the strategy.

When I think of Betfair markets, I see scalping as a strategy that is defined as just going for a very small profit, a tick of profit from somewhere. Generally, this would be at the touch price, but it doesn’t have to be. So I’ve always felt that scalping on sports markets is defined by going for a small profit, typically be a one tick profit. Other people may define it as something else, but that’s how I frame this strategy.

If you narrow your definition of scalping to this one tick then a number of factors come into play. You can make money whether the price moves a little bit or whether it doesn’t move at all. The key to scalping is that you’re just going for a one tick profit. Once you go beyond the bounds of going for a one tick profit then you’re trying to predict a direction and that’s a whole different ball game.

Profitable trading and scalping

As with all strategies, risk management is key. This is because profitable trading is all about balancing out your profits and your losses. If you’re going to go for a one tick profit, smaller moves, you need to somehow have less than a one tick loss. But of course, your loss can only ever be one tick to ensure you balance out at the end. So how do you limit your losses?

The way that you do that isn’t by trying to get less than a one tick loss, because that’s impossible (unless I’ve taught you a trick). What you’re trying to do is get a very high strike rate. So, scalping by default has to be a high strike rate activity. It’s something that you can go into the market and you will most likely get a profit fairly frequently, even if you do it completely at random.

It just turns out that the market wobbles around a bit and gets your order filled and then you have a profit. The way that you minimize your losses on scalping is to go for markets where you’re likely to have a high strike rate. If you want to fully understand this concept, watch the following video.

One of the problems that you tend to face with scalping is you could get a one tick profit and then suddenly the market belts against you and then you’ve got a 20 tick loss. This could mean that you are going to have to do 20 positive trades in a row without failing, to be able to recover that potential loss.

As you can imagine, this is where scalping very often goes downhill and can lead to you losing your money very rapidly. This would more commonly happen in markets that are moving around all over the place, which can be a recipe for disaster.

I think the best definition of scalping that I’ve heard in a one-liner is, ‘Scalping is like picking up pennies infront of a steamroller’. That more or less sums up your objective when scalping.

Which markets should you scalp on Betfair?

As I hinted above, trying to make money by scalping full time on every market doesn’t really work. This is where a lot of people go wrong. If you apply one strategy to all markets, then it is quite likely that you will lose money when trading.

This is because it will work in suitable markets and fail in unsuitable markets leaving you at break-even, at the very best. You can’t afford to take the high risk of losing money by taking a one tick profit and much larger losses when it fails. It’s better to only deploy a Betfair trading strategy that fits the market you are specifically looking at. Therefore, the first thing to do with scalping is market selection.

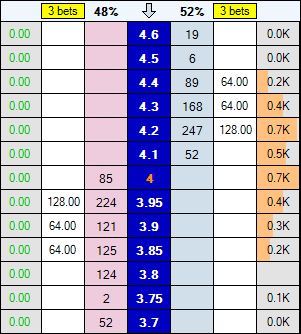

If you can find a market that isn’t going to move much, that’s working in a narrow-traded range, where there’s lots of money coming through, they tend to be quite suitable markets. That’s primarily because you can keep your strike rate high and your potential losses relatively low. If you’re looking at a market that has very little money in it and it’s flying around all over the place your risk factor goes up tremendously. This is why the market selection is quite a key component of scalping.

It’s good to find a betting market where you have very large competitive fields and lots of prize money. You tend to find these markets will be slower moving markets. For example, The Cheltenham Festival often produces markets that are very suitable for scalping. There tend to be lots of orders which are holding the price activity in a tight traded range and the prices don’t generally move that much.

Generally speaking, markets throughout the year that are turning over millions of pounds can often be quite good scalping markets, because they tend to work in a narrow-traded range. This means you can put your order in and out, and you can do that fairly frequently at a relatively high strike rate. With these races, the market doesn’t tend to plunge and move against you dramatically when it all goes horribly wrong.

If you want to practice some scalping, one of the things I found that will help you practice with the minimum of risk is to try some football trading.

This isn’t a ‘lay the draw’ or anything like that, but just doing some really slow, steady scalping in the pre-off football trading markets. This will get you used to getting in and out and knowing what to do, but the markets don’t tend to move very rapidly. This will give you plenty of time to adjust your position if you have made a mistake.

Where Scalping can go wrong

Something that isn’t talked about much, is getting your orders matched. When scalping you could put one order in the market and then put one into the market, one tick higher, or, lower depending upon what you’re trying to do. There are a huge number of ways you can achieve this.

If you are scalping using Betfair trading software such as Bet Angel, the

The risk that you take when you’re scalping is from opening that one position, to closing that position. When you open a position you’re exposing yourself to risk within the market and the position could go against you. When you put your closing position in the market (or when Bet Angel puts the closing position in the market if

One of the interesting things that we can think about here, is that what would be the perfect scalping market? I’ve already covered the type of market we’d like, something with lots of money going through. But we would also love to get those orders filled really quickly.

In essence, if we put two orders in the market and they both get matched instantaneously then we make money for almost no risk. This would be the perfect market. Unfortunately, the reality is you are highly unlikely to get that perfect market. But there are markets that exhibit slightly more favourable situations.

Look at working at the centre of the market, this would be where the current back and lay prices are. If you’re working at the touch price and there’s no money there, and you’re at the front of the queue on both orders you will get matched very quickly. This is a good scenario.

The worst place you could be is in a suitable market, but where there are huge amounts of money in front of you on both sides. This is because it could take ages to get both your orders matched. Al the time that you’re in the market and unmatched, your risk goes up. This means that both orders will most likely not get matched on the betting exchange as people are not taken enough to reach you in the order

There is a solution to this however. You should check out the Estimate Position In Queue feature on Bet Angel. This will give you an estimate of where it thinks you are in the order queue on both sides of your trade. Please note the word ‘estimated’ as it’s impossible to know the full order queue on Betfair betting exchange, so Bet Angel has to make an educated guess. But it’s usually quite a good one. Watch the video below to learn more about this feature: –

Scalping on Betfair, a summary

Back in the early days scalping was simply a case of turning up in a market and offering two prices, which would often get matched. But over time this has changed and devleoping into a more detailed strategy.

Market selection is an important part of

More information and advice

We have a ton of information available if you want to progress your Betfair trading career. Bet Angel is just more than software, it is a smorgasbord of advice and information to help you on your Betfair trading journey.

- Visit more pages on the blog to learn more about many different aspects of the market and a variety of Betfair trading strategies – https://www.betangel.com/blog/

- Visit the Academy to learn to trade on Betfair and get detailed, structured, Betfair training courses – https://www.betangelacademy.com

- Visit Bet Angel TV to see the latest Betfair trading videos and videos tutorials – https://www.betangel.tv

- And of course, don’t forget we offer a free trial of Bet Angel. There are two main versions for all abilities – https://www.betangel.com/betfair/

I hope you found this blog and trading example useful, as long as you remember the important characteristics, mentioned here, you will be a successful Betfair scalper!