So there’s a great way of profiting from trading on Betfair, but on the surface it is unintuitive. People generally get confused by it and most people do it wrong. However, it’s the method that I’ve used over many years… This technique is called trading order flow.

I just thought it was worth doing a post to explain specifically how I trade with order flow and why it can give you an advantage when trading.

Why I trade order flow

So the trick to trading on pre-off horse racing on Betfair is order flow. So what is order flow? How does it influence what you do? And why is it slightly counter-intuitive?

Well, the interesting thing about my journey through Betfair is when I arrived in the racing markets, I didn’t know anything about horse racing. I looked to the markets and it was a complete mystery to me. Handicaps, different grades of races, different courses… I basically had no perception of what I was looking at!

This led to me investing a way of actively trading horse racing that would allow me to profit, despite having a complete lack of knowledge. Over the years, my knowledge has improved so I’ve got a much better understanding of different aspects of racing which has helped me improve my trading. But the core principle of what I do hasn’t changed that much.

Fundamentally, I still work on the same basis when I was novice. Let’s reflect on a usual day of normal racing…

Where I learnt to trade order flow

When I abandoned my first serious attempt to crack gambling markets I switched to the stock market. That is where I learn about order flow trading.

On financial markets, you had a stock exchange and you would use some trading software to look where orders were in the instrument you were trading. If you were trading an equity market you would have the market price, but if you also had level 2 access you would also see or the buying and selling up and down the order book.

Trading platforms and exchanges would vary but ultimately if you put in a market buy orders, they would appear in the market and if you added up all the market buys and sells would allow you to work out if there was any bias to buy or sell in the market. It was a battle between buyers and sellers. If you had an order to buy you could lock in a profit if the price rose, if the price fell you would probably cover yourself with a stop loss.

When the betting exchanges were created, more specifcally the Betfair exchange. You could do the same thing in a betting market. Well you couldn’t actually, you had to wait till software like Bet Angel was created as that would allow you to trade the sports market like the stock market.

Apart from on this ‘stock market for sports’ you were trading horse racing, premier league football, golf or maybe Tennis. But in essense I was doing exactly the same thing that I was familair with in financial markets.

Tricks of the trade!

Let me create a image for you.

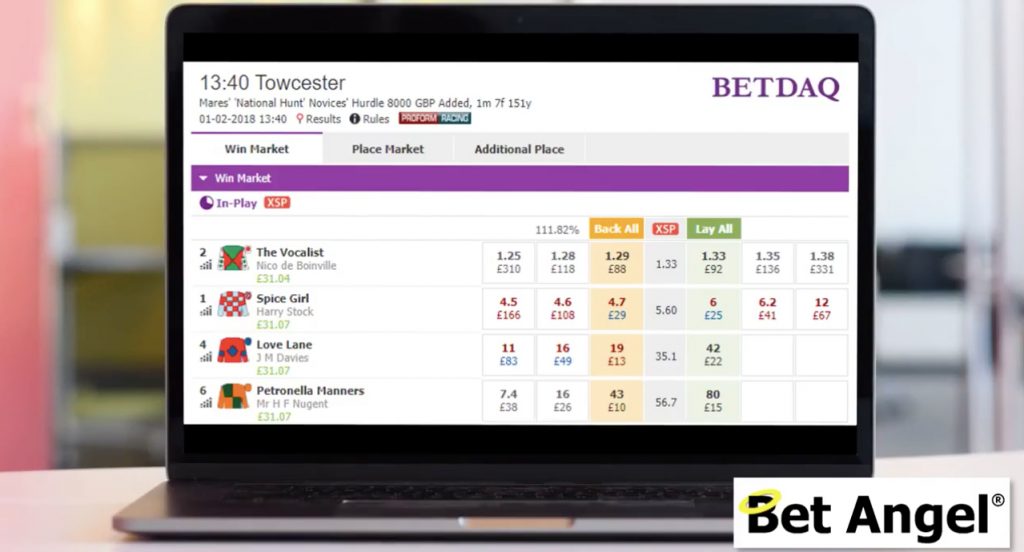

I’ve just sat down at my desk, the racing starts in about half an hour and already I can see there’s a race at Towcester at twenty to two. I already know that there are races that I can profit from already!

I think I know how I’m likely to trade the Towcester race and this pattern repeats a couple of hours later. Why do I know this without any knowledge of how the horse has run this season etc.?

It’s simple – I’m not looking at the horse, I’m not looking at the course, I’m looking at the market and saying this is how the market is probably likely to trade.

When people ask me to help them with trading, this is what I teach them. I talk to them about the market and the way that the market behaves. This can be a little confusing, especially if you are from a gambling background. If you are used to placing a bet you, will have an opinion and will looking to the market to validate that opinion.

The simple fact is the market doesn’t care less about your opinion it will do what it wants. So whether I think the horse is a good thing or not, whether I think it’s overpriced or not. I just look to the market to see if people are predominately backing or laying it.

It is obviously worth knowing a few things about racing to be able to trade it effectively, but where I started and what I essentially do is trade order flow. This involves not looking necessarily at the race itself or any of the runners.

Let’s go back to this race at twenty to two this afternoon. I’ve got a pretty good idea of how I think it will trade. The problem is at the moment it’s only done about £46K in turnover and when the race starts it will probably turn over about £800,000. So you can see the £750,000 missing from the market alone.

Watch the money…

At this stage I’ve got an idea that’s how I believe it will trade, but I don’t know exactly what’s going to happen because the £750,000 has yet to arrive in this market. So I can only begin to form my true opinion. If I took a position now, I think I may get it about right, but my confidence will grow as the money arrives. The more money in the market, the nearer to post time, the more accurate I get.

The reason for this is that as more money arrives, I get more time to watch how the money is arriving and the influence that it’s having on the market. The more information I get, the more confident I will become. So it’s that last 5 to 10 minutes before the start where most of my activity takes place and where I get the best quality clue as to what is going to happen.

All the way out an hour before this race is due to start, there isn’t enough information for me. I’ve got a clue as to what’s going to happen, but I can’t say for sure.

Understanding the ambiguity of order flow

This stage is where trading order flow becomes a little bit harder for people to understand. When you look at the way that people think, they want a yes or a no. They ask, is this going to go in this direction? Just tell me, yes or no?

The fact is, when you trade properly, you can’t give that definitive answer. ‘Likely’, ‘possibly’, ‘on average’ are the sort of words and phrases that I tend to use at this point because you can never say that it’s definitely going to happen.

Even with my 20 years trading experience, I’ll still lose two or three races out of ten because it just doesn’t happen. You set up your trade for the price to come in and then you start following the price as it comes in when suddenly something goes wrong. Money appears out of nowhere, the horse runs loose, rears or something else gets backed heavily.

You’re left thinking, “well, okay, I wanted to trade this one, but I can’t now. It was going to do this and something else has changed…” and that’s the skill. It’s the flaw and the huge benefit of trading order flow, that the market is uncertain as such and by its nature. It will play on your mind unless you are clam, have a trading plan and stick to it.

People tend to struggle to come to terms with that. People are looking for a black and white answer, more than once I’ve been asked, ‘just tell what I need to do in this market?!’

Well, it’s not as simple as that. I’ll say:

- This is what we expect to happen

- This is when it’s going to happen

- This is how it’s going to happen

- These are the things you can look for to confirm that

However, these things may not happen, which is exactly what people don’t want to hear!

But the advantage of that is that because of the uncertainty, it makes the whole process a little bit tougher and unintuitive. Well, how can this be a benefit? Because it is tougher, it’s often more profitable because it is a little bit harder to do.

People come to the market, the concept seems pretty simple and then they try and replicate the trading they see and realise it’s a lot harder than it initially seems. You have to go through a journey, a sort of apprenticeship, to really truly understand the objective and also how to handle uncertainty. It’s tough if you have never traded before as the market also seems to be looking over your shoulder half the time. You almost need to invert your thinking.

Very often when I tweet about a trade like the example above I always get it bounced straight back into my face and someone said ‘you’re after timing,’ ‘why didn’t you tell me before it happens?’

Well, the fact is, when you’re trading order flow, you don’t know this far out. You can’t specifically say before it’s happened.

In a nutshell that’s the another wonder of order flow, it’s slightly ambigous and that in itself means people very often just can’t understand what you are doing. But the fact it allows you to profit regardless of who goes onto win is obviously a very alluring prospect.

In the next article we examine further information and advice that will get your started on your path to understand one of the most popular Betfair trading strategies.

What did you expect to happen in the example?