What is Betfair’s biggest ever individual market?

Ask people what is the biggest ever Betfair trading market ever and you will get a variety of answers. Horse racing never has the time to build up huge volume to get big enough. Only markets like the Grand National build volume pre race for a long time, most other markets have short run-ups. Tennis was one of the first sports to make it big in play and start receiving a large volume of bets with the markets turning over substantial amounts of money. More recently Cricket trading has come to the fore and generated some spectacular totals. But the biggest ever market may come as a surprise to you, it’s probably not what you would initially think!

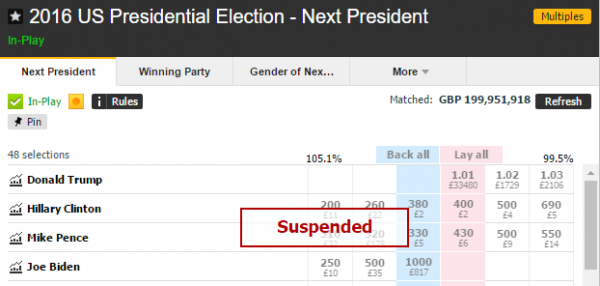

Unusually for a betting exchange site, more used to taking money on sports betting, it’s a political market. Betfair’s biggest ever market was the 2016 US Presidential market.

Punting on Politics

Politics as a whole is fairly dull most of the time and I can’t imagine the Betfair exchange getting a large volume of requests to add the latest market to exchange. Most of the time they are quite dull these are the sorts of markets where nipping in and out with trading software is the key. But they do through up some really big markets.

Gathering data has always been the way to develop trading strategies for me, so I’ve done the same on politics. It’s a tricky market to model, so observing how they behave has been key. I started looking at punting on politics on the Betfair betting exchange back in 2004. Hillary Clinton was a democratic nominee back then, but John Kerry went onto battle Dubya for president and I’ve revisited each year since then.

How I look at the market

I think you will see that most Political markets are driven by polling news and the polls are influenced by claim and counter claim.

In the run up to the any vote the market tends to react to news flow. So trading in and out of that gives us a chance to profit from it, even though we don’t know what the next bit of news is. The battle ebbs and flows from both sides, so you tend to oppose the most recent news and as the other side come out with a new story the market will shift back in the other direction. That’s more or less how I traded most political markets.

On the big voting day its like the event has gone ‘inplay’. It reverts to what is happening in the underlying event, i.e voting. I tend to study voting patterns and polls to get a clue as to how the market may react to news as it broke. Exit polls will significantly shift the market. In the US voting is split into regions, which cover four time zones and that means the market tends to react as news rolls in. It seems to have followed roughly the same pattern each time. I guess this is due to the number of factors included how votes are returned and counted and this in part is due to the geography of the US.

I’ve done a video on it and you can see the voting maps and progressions on this video: –

Politics is, unfortunately, a booming market

It’s amazing to see how much politics has grown as a market. Have a look at the 2008 election when Obama was about to win.

Then wind forward to 2016 when this market became the biggest individual market ever on Betfair. It matched just short of £200m in the end. That’s pretty substantial growth and it broke the previous record of £114m, which was also a Political market, the EU referendum. There is something curious going on with Political betting markets it seems! I’m not totally sure what the reason for this is. If you have any ideas then feel free to offer them up.

What drives a big market

Big reversal causes big markets. This is probably because people try and reverse out bad trades. The EU referendum market traded at 1.06 before doing an about-face and rushing away in the other direction. So markets that hit a low but settle in the other direction, will always end up on big totals.

I’m a real stickler for accuracy and detail, so I collect a lot of data on each market I trade. The detail on this graph is probably too small to accurately asses so here is a quick overview on what happened in the US presidential market.

Clinton drifted slightly as the first polls started to trickle in, but shortened to 1.08 at 01:04 in the morning UK time. A gentle drift ensued till 02:00 hours when the results were starting to show a bit of pressure. The price really started to move rapidly from there as we headed through the East Coast and into the Mid West. Forty minutes later Trump touched odds on and never really looked back. By 03:26 a complete reversal had taken place and Trump was now at Clintons price of a couple of hours earlier and the Democrats dream of not only the first African American president, but also a women in the white house, was in tatters. Things just got worse from there.

It was a fascinating night and an unbelievable market. That often seems to be the case with political markets and I’m sure there will be a few more of these in the future.

[…] I have no idea why, but one of the markets I’ve collected data on over the years are Political betting markets. A bit unusual for somebody that is predominately into sports betting but you could say that politics will be one of the favourite sports over the dinner table at Christmas! The first market I ever looked at was the US Presidential race in 2004 and the last one produced a whopping £200m in matched bets! You can read more about that on this blog post. […]