One of the myths about Betfair trading is that you need a large amount in your account to trade effectively. But also that you have to be some genius at predicting a potential price move.

My experience in the market actually points to the opposite. A smaller bank is a much more effective way of getting a good result and being roughly right, is an understated objective.

My start point

When I started trading seriously I set up a £1000 trading bank. But I immediately split it in two and started trading just half of it. Why did I do that?

I split my bank so if I completely messed up the first attempt I could slap my wrists and go again. Taking that pressure off my shoulders would help me trade more effectively in the first place.

I never needed that second half of my trading bank.

The market

It may seem glamourous to have a big trading bank, but it isn’t.

The problem with the market is it’s there to take money from you. If you slip up then there is somebody waiting to pounce on your mistake. But also it’s made of many different participants. I don’t tend to know much about any individual runners in a horse race, so I have no idea if it is value or not.

Other people in the market will be poised to jump on a price if they think it is value. So if I’m stupid enough to offer them some, they will surely take it. This means that it’s easy to get into a position and often much harder to get out of a bad one.

You may have experienced this at some point. Taking a bad position seems easy, a good one much harder.

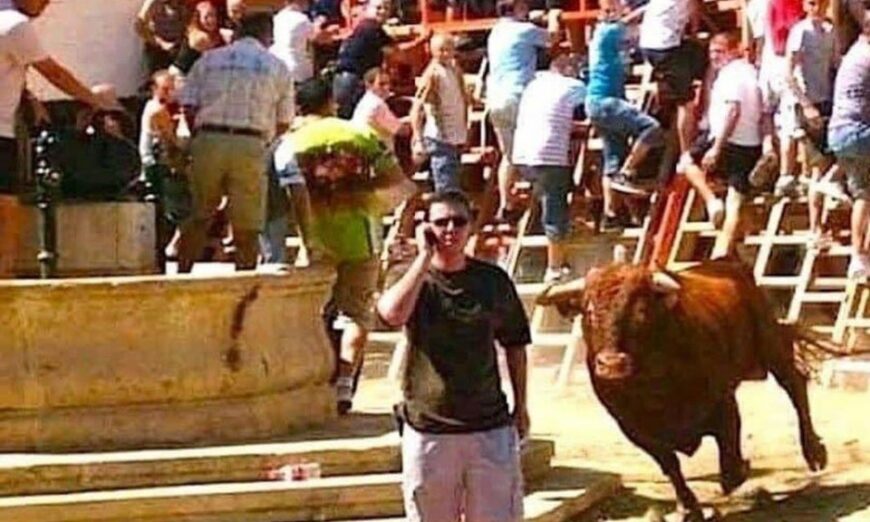

You can hold, dear to your heart, an opinion about your position. But the market will charge through your position like a raging bull if you let it. You need to stay alert at all times.

Liquidity

The longer you leave a bad or neutral position in the market the more chance it has of going against you.

So your perfect trade is to be in the market and out again in a fraction of a second with both sides of your order taken in full. This is also a completely unrealistic situation most of the time!

Therefore, one of the ‘tricks’ of trading is to always stay inside the liquidity of the market. You can get in easily and get out when needed if your stake is within the latent liquidity of the market. If you use a stake that is too big, you may have trouble entering or exiting the market.

A lot of my markets end with a small win or loss, but generally much smaller losses. Simply because I choose appropriate markets and if it isn’t working I just get out. That’s a lot easier with smaller stakes.

Using a stake that is appropriate for the market will allow you to get in and out without your stake influencing the outcome of your trade.

Individual staking

When you see some bigger trading results that I post, it can be tempting to think I’ve waded in and out of the market at the perfect point with a large amount of money. The reality tends to be wildly different.

Yes, sometimes you find the perfect trade, in and out at the right time, with the right money and strategy. But that’s not reality. If you are seeking perfection it’s almost certainly something you will never find and you will never be a trader. Trading is all about taking risks but trying to mitigate as much ‘knowable’ risk as possible.

So I try and get a good average entry and a good average exit. You see me do this time and time again on videos. Getting into the market at roughly the right place and putting in my closing trades somewhere where I think they will get matched.

So the vast majority of trades you see from me will be average ins and average outs. Me opening then closing a position. Restarting it, changing my mind, netting it out, putting more in, taking some out, moving my closing positions. A mixture of many different things. I prefer to trade with smaller amounts and build and loosen my overall position.

This is how real trading works!

If you crave certainty and precision, perhaps find a different occupation. You won’t find it in trading and if you do, you a probably doing it wrong.

What risk

When I open a trade in a market, I have a limit of liability that I am willing to risk. I know this before I start trading any market. But that risk is not defined by my stake or the liability on any one particular bet within that trade.

Your role as a trader is to put money in the market, then take it out again with a bit of profit.

If you judge your trading by the liability you have on an opening lay bet, for example. You are NOT trading, you are letting your risk be defined by a traditional bet. The way you should look at risk is to know, that of the stake you have put in the market, only a percentage of that will be ‘at risk’ at any one point.

Say we have a £500 trade in a market. The market could move for or against us by 10%. That is your risk, not the underlying value of a bet. So you shouldn’t concern yourself with that, just focus on the trade. If you worry about the former, you will not trade effectively. I only look at net stake when I am trading.

I constantly ask myself, is my current position too high, too low, about right? Do I add to it, subtract from it? How much time do I have left?

As long as that net stake is zero by the time I hedge, that is all I care about. My trade will be complete at that point.

Summary

Successful trading often isn’t some wonderful insight you had about the market. Nor is it about having a large bank, that can actually be counterproductive. It’s more about identifying potential opportunities. Then about trying to make the best of them while keeping your risk under control.

Do that and you will be a good trader. Practice it often and you could become a great one!

Basically, when it comes to the Market, it’s best to choose the one that is closest to our heart, which is simply the sport that interests us. It will be much easier for us to make a profit if we analyze the markets that interest us. The same goes for deep research, because who would want to take into account a sport that does not attract us at all? Exactly.