My first sports trading market

On the 18th of June 2000, for some reason at 22:24 at night, I opened my Betfair account and the rest they say, is history…

Curiously it wasn’t the first betting exchange account I had opened. Back then you actually had a wide range of choices. So one of the first exchanges I actually used was Flutter. Flutter and Betfair turned out to be the early dominant exchanges until they ‘merged’ a little while later.

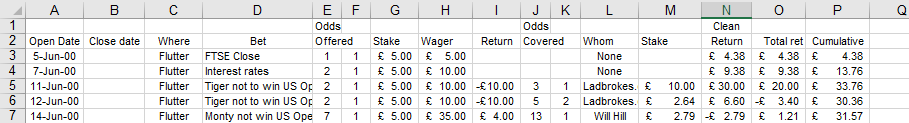

One of the first bets, trades, matched betting, arb, or whatever you want to call it was on the US Open Golf. I say the first-ever sports trading market, as I have to qualify that somewhat. That is because, coming from financial markets, my very first port of call on the exchanges, was on a financial market.

I’ve carefully documented my entire journey and did that right from the first bet I placed. So that is how I can tell you that the first bet on a sport was the US Open golf. I was arbing between the bookmakers and the exchange. It wasn’t that impressive, to be honest!

Like everybody, I started at a low base. My first few bets were just £5. One of the things you learn when you are pursuing an edge is that any edge whatsoever multiplied by thousands of iterations, or markets if you want to simplify the language, will result in big numbers.

Putting your balls on the line!

From that very simple start, I started to build. Build my confidence, but also the money in my account. For the early part of my career, I set up an account and deposited a fixed amount. I can’t be sure exactly what that was, but I imagine it was probably about £1000.

To protect myself against errors, I split the bank in two and a half was a ‘reserve’ amount. I did this because if I messed up and make a mistake, I could fall back on the reserve amount, dust myself down and start again. I never need that reserve amount.

Part of this discipline came from my efforts in financial markets where I’d learnt, the hard way, how discipline was a key and critical part of trading. You need the freedom to act on an opportunity when it happens, you need the ability to put your balls on the line. But you also need to do it in such a way that your risk doesn’t get out of control.

I started small but slowly increased my stake as my bank grew. That way I never risked my whole bank at any point.

How to achieve something special

Of course, my tiny efforts at the very start of my career were never going to make me achieve something special and ultimately that’s what I wanted to do.

I was in a really well-paid job, but I could see this opportunity and wanted to really go for it but a key problem was in front of me. How could I bet at the level where I could actually do this seriously? The key issue with that was that liquidity was low on the exchanges and small stakes were never going to be enough. Also, I was just starting out, and I didn’t know where the limit was.

So slowly, but surely, with each market that passed, I incrementally increased my stakes and my knowledge in individual markets. There was no great leap, no waking up one morning and discovering something new. It was just a slow, incremental, progress. Eventually, the numbers got big enough that I felt confident enough to quit my job and do this full time.

What my US Open Golf bet looks like now

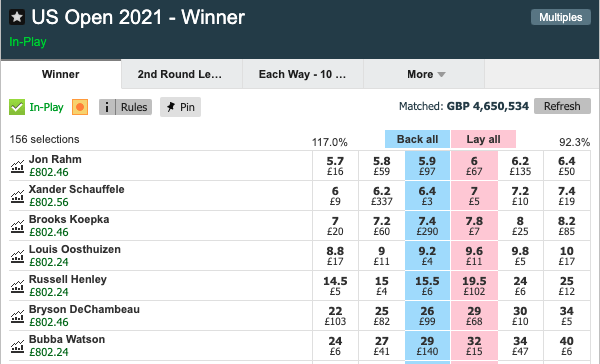

Since that first bet on the US Open Golf and over the intervening 20+ years, I’ve gradually improved my knowledge of Golf, individual courses, individual players and how a tournament is played. I also developed an odds model for Golf. When I started out that looked impossible, but as my knowledge grew and I watch more and more markets, I figured out how to do it.

Of course, my confidence has grown. When I place a bet or take a trading position in a Golf market, I’m pretty sure it will all work out overall. Of course, you are not assured of that, but with time comes confidence so you make ‘firmer’ decisions.

Then we get to the staking. Over the years I’ve gradually increased my staking. If you use small stakes, you don’t accidentally influence the market, but too small and you don’t make much. So there is a sweet spot in the market where you can use reasonable stakes, but not too much. That is why you tend to see me focus on the Majors, they have the right mix of tight spreads and good volume.

I took the screenshot of the US Open just before finishing on the second day in 2021. My fully hedged Betfair trading profit across the field was £800, or 160 times my stake twenty years ago!

But of course, that dramatic rise actually occurred, step by step, over the course of twenty years, slowly, methodically and in a way that was deliberate, confidence-building and structured.

So when you see trading images like the one I have posted. Realise that if you want to reach the same goal, there are no shortcuts. If you take one, it will probably influence your chances of success. But if you are prepared to work hard enough for long enough, then there is no reason you couldn’t achieve the same!

Ultimately, you need to get a good understanding of what you are doing, the tactics you use, the market, and the sport, then build the confidence to act on your information. There isn’t really a shortcut to confidence, it’s just experience.

Something which I now have a lot of.

To gain that experience, just keep practising and try not to do anything silly to reach your goals. As long as you are doing the right thing, time will always reward you.