Now as we come towards the end of 2020, you may be tempted to reflect over the profit you have made over this last year. Some of you, you’ll be hoping that 2021 is a lot more hopeful and you’ll be thinking about how much can you make next year? Could it be £100,000? £1 million? £10 million?! What should be your actual target?

There is actually a very simple (and sensible!) answer for you which clearly defines exactly what your objective is and what targets you should set when you’re Betfair trading.

Why can some targets be bad?

One of the things that you need to be careful about when you’re trading, is setting targets. Earning money is obviously important and having a realistic target is a key aspect of what I look for when people approach me and need advice, because if somebody comes to me and says:

‘Right Peter, I need to make two hundred and fifty quid a day and I’ll be happy! How do I do that?’

If you’re saying this, then you’re looking at it the wrong way round! Trading itself isn’t something that lends itself particularly well to that method of operation. Yes, you can set a target, but setting a black and white arbitrary target at a top level isn’t the way to go. Trading, to a degree, works the other way around.

If you look at my long term P&L, what it tends to do is follow the sport cycle. By looking at it over the course of the year, January and February are quite quiet and then it begins to rise in March and then it peaks in the summer where it drops as we come out of the summer months. You see it follow the cycle of the sports that I’m trading throughout the year.

Of course, the cycle includes or doesn’t include one sport or another over the course of a year. So, your cycle will be slightly different to mine depending upon what you choose to trade and when you choose to trade it. My mantra is always to trade the most while the sun shines in the summer, there’s so much going on and that makes it’s perfectly possible to make good sums of money.

But I’m not expecting to do that in the winter because there are fewer events going around during that time of year so I’ll have fewer markets to trade and less trading strategies to deploy into them. So it is foolish to have a target that is the same in summer as it is in the winter because you’re very likely to do much less at certain times of the year and much more at other times of the year.

It makes no sense to be able to have a standard target and then just liberally disperse that across the year.

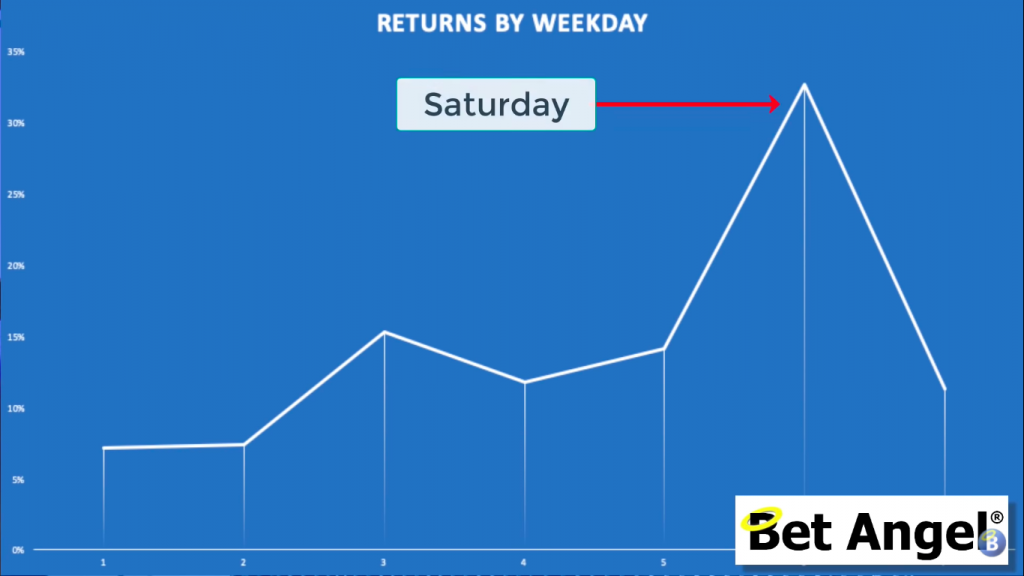

This even works for me if we go down to a weekly basis on pre race trading on the Betfair exchange. Most of the money that I make tends to occur towards the weekend because that’s when most of the sporting activity is on. It’s not always like that, because you do get little bumps and peaks at other times depending upon what you’re going to do, but generally, it is skewed towards the end of the week.

So even if I have a bad time at the start of the week, it doesn’t really matter because by the time the weekend comes, I’ve got plenty of opportunity to make it up. However, I don’t look at it like that! I don’t look at it as though I’m making up a certain amount of money. That’s just part of the cycle.

It’s useful that the week finishes on a Saturday for me. Early in the week, there’s a lot less opportunity and there is less money in the market. So it’s Mondays and Sundays that are the days I usually take off or do other things as it slowly peaks up until the weekend (typically on a Saturday like shown in the image above.)

Ultimately, the amount of profit that you make is dictated by the market and the underlying events within it. Now this is how you need to objectively look at what potential profit you have. Luckily for you, I’ve got a really simple way of doing that…

Focusing on the long term

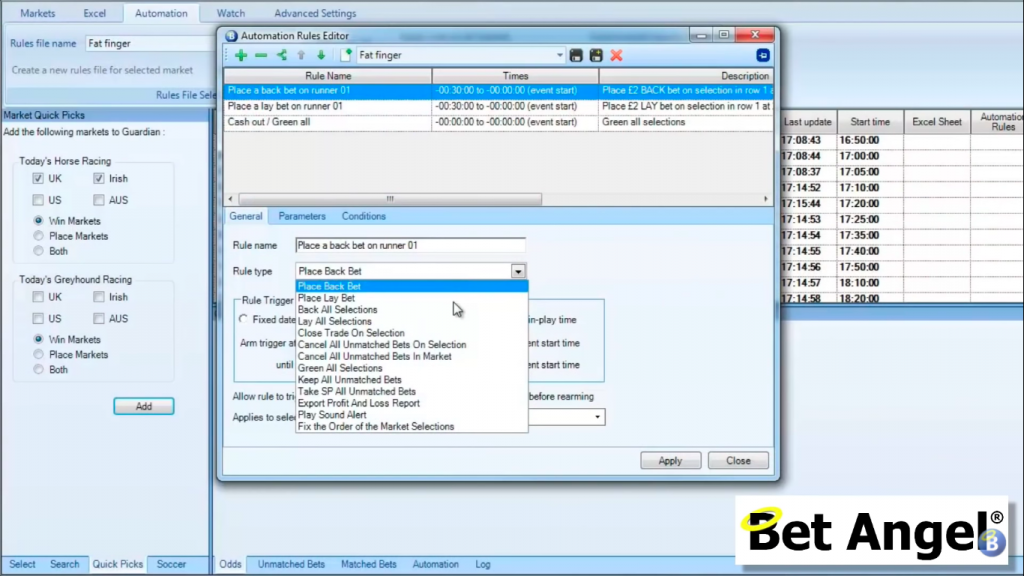

If you look at my activity on the markets, one of the tricks that I have is that I’m trading many more markets now than I ever have done in the past. So when I first started on Betfair, I would basically go on the screen, place a position and then close the position out. That was pretty slow and laborious and meant that I couldn’t do that many markets. Then Bet Angel was born and it was possible to do a lot more with and much quicker within the market.

I was able to put additional trades through more markets and more frequently across a wider range of sports. As time has gone on, you’ve obviously seen Bet Angel progress and now we’ve got the opportunity to be able to automate as well. It’s great to be able to do that because it means that I can simultaneously participate in a range of markets while I’m actually trading another one.

So it’s perfectly possible to do all sorts of weird, wonderful and crazy things many times over in a whole range of markets!

The opportunity is bigger than it’s ever been

Thanks to Bet Angel and now Automation, necessarily the scope of my opportunity is much bigger than it ever was. So that’s one of the reasons that I perform so well overall is because I’ve got something going on pretty much 24/7 all of the time!

Even if I’m actively trading in front of my screen, I’ve got other versions of Bet Angel doing other stuff in other markets or even on the same market, but exploring a different strategy.

So that’s one of the tricks that I now have, which allows me to hit that number. It’s the ability to be able to do more things within it. However, that reduces your risk as well because if you think about it, your target isn’t to do one amazing £200 trade, you could actually do five smaller trades to get up to a decent number if you so wish.

That’s the crux of where we’re getting to here, because if you set an arbitrary target of £100 in any one particular day, you’re going to be limited to achieving that target by however many markets are involved in hitting that particular number.

What you need to do is stretch out your time scale and make it much bigger and longer, over wider time scales. So if you say to yourself that you just want to be profitable over the course of the week, if you only trade 5 markets, there’s a lot of pressure on for you to get those 5 right.

However, it’s perfectly possible you could trade hundreds in a week. Therefore, your target becomes a little bit more achievable because you lower your stakes down, which involves little less pressure on you.

It’s easier to actively trade with smaller amounts when you’re active in the market. You wont feel much pressure when you have a losing position or trade.

£1K short term target? Good or bad?

Let’s use an example, for this I’m going to use an arbitrary money, I don’t suggest you set this target, but it will help you gain perspective.

So our target for the week is £1k and I’m going to trade ‘x’ amount of markets. If you trade five markets and your target is £1000, you’re going to need to pull out a £200 trade without any losses to be able to hit that target.

That’s a bit of an ask, if I’m honest!

Now, if you say my target is £1k and I’m going to do it in a thousand markets, all of a sudden you collapse your objective and you’re not relying on one mega-trade. You basically say that on average you are making £1 each out of these markets, so I could be up to a £2 on one particular market, down £1 on another, up £5 and another £4, up £6, down £3 etc. That way you aim for a target that’s much more reasonable and manageable which is perfectly possible! Another benefit is that include and expect losses.

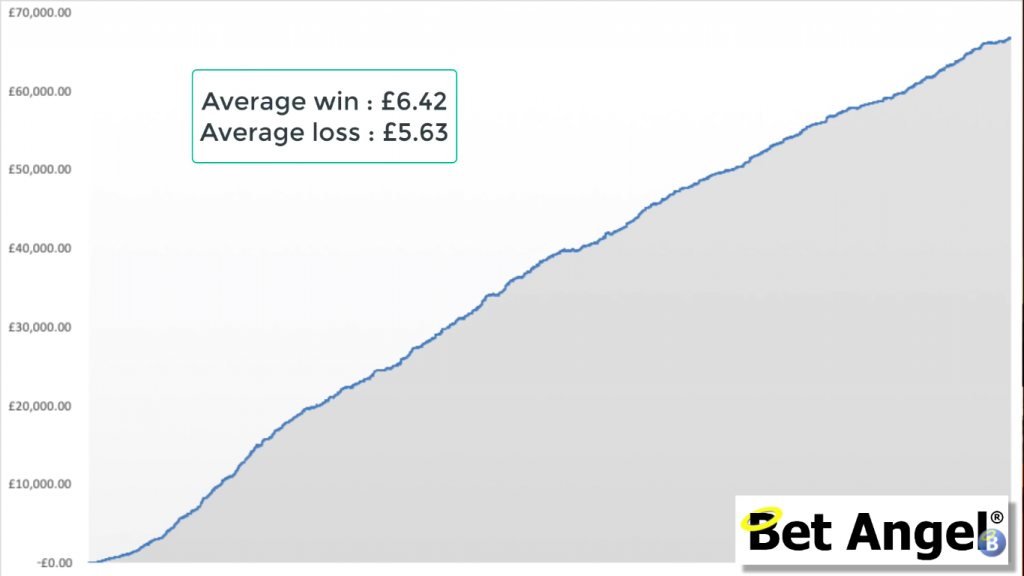

I have an automation strategy that I use and off the top of my head, I believe it’s probably made £60 or £70k. If you look at the way that it was achieved and the equity curve (an equity curve is looking at the cumulative P&L) of a particular strategy, what you see is it’s just a gradual climb over a very long period of time.

The individual amounts that I win and lose on there are relatively small, so you see my trick that I’m pulling here is simple: I’m just doing a lot of them!

It’s a lot of money at the end of this particular total, but the actual amount of money that’s involved any one time in the risk that I’m taking and the amount that I’m yielding per market is actually pretty small. Of course, this runs parallel to all of the stuff that I’m doing manually in the market it just goes doing its business in the background. Then I can look at it at the end of the week go, ‘oh yeah, it has been a good week’!

However, the more markets I put into it, the more it will yield and the fewer markets I put into it then the less I will yield. By doing it over a very large number of markets, the actual overall objective is very achievable. So yes £1K can be a good target, but it shouldn’t be a short term target.

Setting achievable goals

So if I said to you, can you pull off a £200 trade at the next race, you may look very shocked at me and you may not be able to do that! But if I say to you your objective is to make £1 a trade, then obviously you think, ‘well, definitely I can achieve that!’

Now it can simply be a case of replicating this when going forward. If you look at it from a broad perspective over a year, say you wanted to make £100,000 a year.

You set a target of trading 50,000 markets. Therefore, if you do the math – £100k/50k = £2, £2 is the amount you would hope to make on average.

Obviously, this wouldn’t work out perfectly where you’ll win £2 in every market. In some markets, you’ll win £5 and on other markets, you lose three quid and it averages out +£2. So all of a sudden, you’re thinking, could I get £2 out of a market?

You see this is a much more reasonable target than trying to earn some stupendous amount out of the market which will probably be at a much higher risk. So when you set a target, that’s ultimately the way that you should be doing it. It’s like writing up a business plan of sorts!

You see that’s where I want to end up! It’s a much better way of looking at your risk and your money management and what you’re trading objective is. It is better than trying to meander your way through it. You could end up throwing money at it left, right and centre and then find yourself up against a target and then slipping backwards.

It can get messy! Remember: it’s best to have a definable pattern of behaviour.

I know how many markets I’m likely to trade next year and the interesting thing is the number of markets that I trade on average is actually accelerating at the moment. With all the work we’ve done with automation and semi-automation, especially with aspects like Servants, it is things like that which increases my capacity to trade.

Not only am I trading more markets, but I’m putting more trades through those markets. As a consequence, my account turnover and the profit continues to rise simply because of the large number of markets that I’m able to participate in.

You don’t have to go for those big, you know, glory seeking massive totals on any individual event. Your objective is a little bit more subtle than that.

£100,000 in a year is it possible?

Curiously, in my experiance, It’s easy to achieve bigger targets if you focus on small average profits over a large number number of markets, not setting a large target per race.

Now, If you’re looking at how much money you could possibly make it’s important to note that if you’re starting out to say you probably won’t make any money! Ultimately, what you’re looking to do if you’re trying to get to the stage where you earn a decent sum of money, is looking for a much broader objective.

You’re not saying I need to make a certain amount over this period of time, you’re prioritising the idea that you are going to trade ‘x’ many markets and therefore this is my overall objective. It makes life a lot simpler and easier to cope with. It also significantly reduces the amount of stress that you have when you’re actively trading.

Don’t look at your P&L

The other thing you can do is not look at your P&L, if you look at your P&L and you have a figure in mind that you’re attempting to achieve during a certain time period, then that tends to force you to pursue more aggressive strategies when it isn’t going well.

It may be that the market just isn’t in your favour at that moment in time. You just have to keep on ploughing on and doing the things that you know are right and eventually, it will turn around at the end of that longer period. It’s sometimes hard to stay patient, but it may take more than a week, a month for you to even out. Many a small loss can turn into a much bigger one if you are chasing a target.

Summary

If you want to know how much you could possibly trade and how much money you could make from that trading, I think that your objective really is not to set that arbitrary figure, but to look at the number of markets you’re trading and set your total trading goal from there.

So do you think 2021 will get you that big profit? Remember, don’t fraternise with your losses, it is your goal to end up positive overall on average. With that mindset, it will help you succeed and possibly reach that £100,000…or whatever your target is.

Thanks for giving us the benefit of your wisdom. I have been the biggest hinderance to my own progress over time but you have been my biggest inspiration.

Thank you for your comment. I’m happy to share my experiences but it’s easier when I know I’m making a positive difference.

Hi Peter

Thank you so much for your advice. I’m busy developing my business plan for 2021 thanks so your video. I am new into trading and starting with a healthy mindset takes a lot of pressure off myself, I can then focus on trading more efficiently on a daily basis……continued learning. Your video’s and blogs are fabulous and a tremendous help, thank you so much.

Thank you for dropping by to leave that comment, it’s appreciated.

Excellent stuff as always. People put pressure on themselves and then make rash bets!

Fantastic article.

I’m not so new to trading but new to actually making a regular profit.

That’s all down to me getting the best out of betangel.

The angel is a fantastic bit of kit.

Many reviews are starting to put Geeks Toy as the preferred software but I totally disagree.

It’s definitely a bit cheaper but is it better?

Definitely not.

The guardian helps me organise myself as to which markets I plan to trade that day.

The watch list is brilliant!!

I can keep an eye on all the tennis matches I plan to trade and click in to the market easily when it’s time to execute my strategy.

The only thing it can’t do is help with the loneliness that sports trading brings.

My trading technique is a bit raw.

With horses I tend to scalp by 2 tics around 3 mins before the off. I try and get 3 to 4 trades in.

Tennis I tend to back the server and off set by 4 tics. But research is key in tennis, risky backing the server when their 1st serve stats are no more than average.

I use the auto green.

I look for 400 trades a month.

You can’t win every trade but off setting with an auto green has definitely given me an edge.

I’m off to Malta for a few moths once this lockdown is over.

So I’ll be looking at your VPS, I’ll probably have a few questions.

Anyway, I was earning around 20k a year working, thanks to your Betangel I can easily earn that with my laptop and the market over view tool.

I’d love to meet other traders.

I know loads of gamblers but they are to impatient to ever be traders.

They want to win 2k on a treble, making £10 a race to them is not worth the effort.

Thanks again for the article and here is a massive pat on the back for the Betangel

Thanks for your comments, James.

A lot of ‘reviews’ are used simply to grab a bit of traffic by focusing on high hitting keywords. So they are not representative of the products.

Also, Bet Angel has been upgraded regularly, so a lot of reviews are hopeless out of date anyhow.

But it sounds like you are on the right track anyhow!