This is a phrase I’ll often quote when advising people on how to trade. Little and often soon adds up.

Your real objective when trading

It’s lovely to bang in some massive results now and again, but generally, that’s not what trading is about. But they tend to be the exception rather than the rule. They tend to be clustered around the high-profile race meetings that occur throughout the year.

Most of the time I’m in a market. I’m just looking for an opportunity. Something I recognise as having a decent chance of a payoff with as little downside as possible. Sometimes you just can’t see them, and sometimes they are all over the place. But generally, my main focus is not on making money, generally just not losing it.

By that, I mean I’m actively trying to reduce my chance of a loss by not participating in a market I can’t ‘read’.

I tend to reduce my stakes when I’m less confident or wait carefully for an opportunity. I know I will get a profitable trade, whether I am looking for it or not, so I’m just trying to reduce the risk of it going wrong.

There is often an impulsive tendency to do something when trading, but I’ve learnt that patience is critical. Let the market be your slave and not your master. If you can’t see an opportunity, it probably doesn’t exist.

Strike rate

The worst you can do over long periods when trading is winning 50% of the time. If you practice a bit, you can bump up your winning trade percentage by getting better and better at spotting opportunities.

Once you are in a profitable trade, you need to squeeze what you can out of it. This helps you tip the balance in your favour when the inevitable losses arrive.

Avoiding a loss is often a case of realising you have been an idiot and exiting quickly when your fantastic theory behind a trade has broken down. Many struggle to do this; it requires humility, self-criticism and a cool head.

Sometimes, things just don’t work out, and you may not even know why. But realising that is the key. But there is also some focus required on the upside.

Often, the biggest mistake I make is hanging on too long. A fantastic trade ends up collapsing to a modicum of itself by post-time. But generally, you are not aiming for that massive total; you are aiming for something much smaller than that.

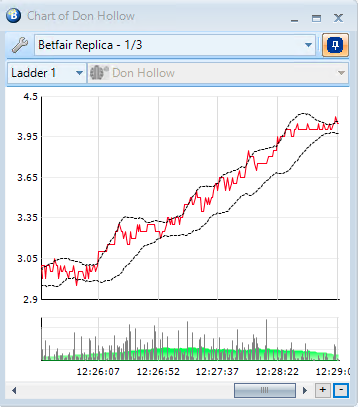

The average range in a market is reasonably predictable. Therefore once a move has taken place, you would typically expect it to have its limits before it starts to correct itself. Therefore as soon as I enter a trade, I start putting my closing positions in much further up or down the ladder.

This means I know where my potential exit is, get near the front of the order book and can manage my positions around that ‘frame’.

Quantity and quality

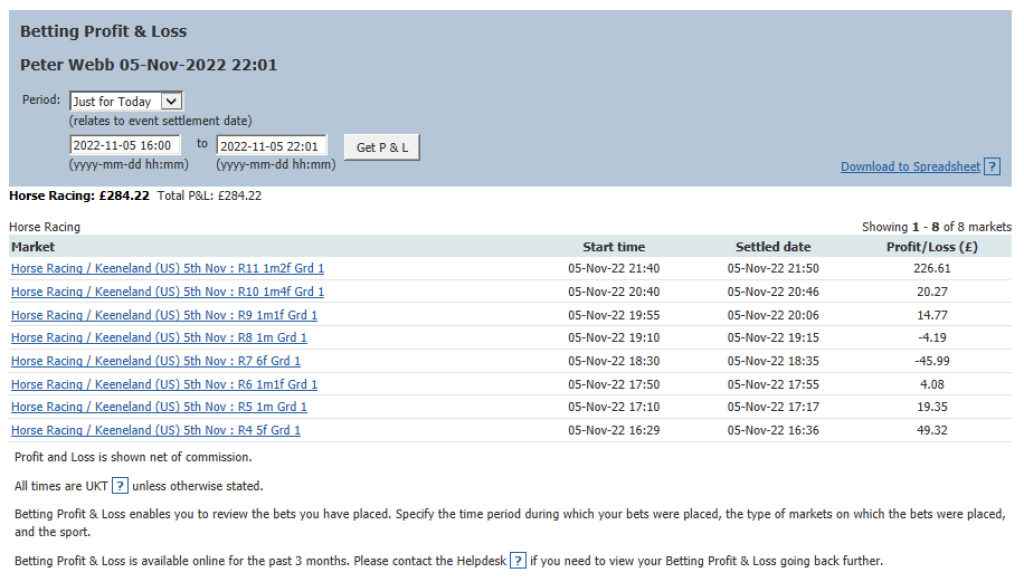

I’ll trade around 1000 events a week, on average, this year, which means I don’t need much per race to get a stupendous result on the year.

But even then, I’ll lose on about 30% of races. My P&L is also bumpy, with positives, negatives, and some break evens. It’s not a smooth path at all.

I just need to pick up something from most races, and that will do.

If you have that mindset, you will have a more balanced approach to things. Over the course of a day, week, month and year individual results will vary, but if you focus on the long-term goal, it will help keep your primordial urges in check.

When I see a good opportunity, I’ll take it, but most of the time, I’m just biding my time waiting for it and trying to not get into trouble.

Knowing that you are aiming for something realistic means that even if you have a bad result, you can forget it quickly, move on and not let it influence what you do next. On the opposing side, if you get a good trade, I tend to look at it as though it’s funding a few losers or slightly bumping up my average.

A level head will give you a more realistic objective and stop your behavioural biases from interfering with your trading.

But the overall objective is similar: little and often soon adds up!