We have just finished the peak of spring racing in Australia. Each year I put a lot of effort into doing my best on Melbourne Cup Carnival and especially on Melbourne Cup day.

This year I’ve managed to get a record result from the Cheltenham Gold Cup, Grand National, Derby and just bagged a decent result, though not a record, from the Melbourne cup. Contrary to what some people will say, I didn’t need a big bank to do that either. Let’s explore, in horse racing markets, how different trading a small race is from trading a big race.

People are often intrigued when I post a large amount from a big race. But what am I doing differently?

Market risk

Most markets can be defined as having a certain level of risk. If you are trading a race where none of the horses has run before, then the market simply can’t know what the correct price should be. It can guess, but it can’t know.

One of the key problems for you is that the market can move a lot in both directions. This means that as well as potentially producing one of the great trades of the month, a race like this could potentially produce one of your biggest losses as well!

I tend to see that as potentially producing a large loss. I tend to frame a trade around the risk that it could go wrong. Now you could accuse me of being negative here, but actually it’s a good thing.

When you identify a market that has the potential to move. If I find fundamental criteria that convinces me that it’s going to move in a certain direction, then I’ll enter the market with an appropriate stake. One that’s proportional to the level of risk that I think I’m taking. But if I can’t see a reason to enter, then I do nothing. Another one will be along in a minute.

Overall when I put a position in the market, I’ll probably be a little bit more cautious. Only adding to my position when the move really begins to get underway, is confirmed and I understand what’s going on.

Strong versus weak markets

Now let’s contrast an unknown horse that is never raced before on a course that isn’t known for producing the highest quality, with a race at the other end of the scale.

This is a race where everybody knows the name of the horse. Everybody has a good idea of its form and they feel they understand how it’s going to run. Not only that, it’s running against a plethora of very good horses in their own right. As a consequence, the market will be a little bit more certain about the true odds of this particular horse.

All of these horses are very strong form lines. Everybody understands what they are going to be like and how the race is likely to be run. Everybody’s been tipping one horse or another. The pundits are analyzing every single aspect of the race and very often, in the bigger races, most of the crowd as well.

Therefore, it’s less likely that there will not be a very large move. It’s not impossible, because these situations do occur. But it’s much less likely.

How my approach changes in a ‘big’ market

So how does this affect the way that you approach the market?

For me, it’s a very simple part of the equation. If I expect the markets to move significantly then I’m focused on attempting to get that move correct. I need to understand where the market is going and have some certainty about it, with the ability to read the market.

On these occasions, I tend to use smaller stakes, but those smaller stakes produce bigger returns. My attitude to risk is to move my things up and down according to a level of risk I’m likely to be taking. On a large market, I feel more comfortable using larger stakes simply because there’s more certainty with the way in which the market will move. Liquidity will generally be higher, and the money will arrive earlier.

But more importantly, you also have the ability to dump a large position quickly in a large market. That sounds brutal, but if you are holding a large position and it goes wrong, you want to get out as cleanly as possible. I prefer to get rid of a position quickly and forgo a potential profit than hang on for dear life in the hope a position gets profitable.

When trading a large market, I’ll put a lot of orders in the market, but I may scratch 30% of my orders. It’s easier to speculate in a large market because you are more likely to be able to exit quickly for a minimal loss. On a smaller market blink and it’s moved.

Volume is not liquidity

It’s important to differentiate volume and liquidity. Will good liquidity you can get in and out of the market easily. Volume really counts for little. Plenty of other exchanges have volume, but not liquidity. But a function of the two will tell you how to trade.

Volume is the amount the race will turn over. Liquidity is the rate at which it is getting matched. In a low liquidity market, if you do commit yourself to a position. Then it’s quite likely that you will struggle to get out if things go wrong. If you look at a larger race. It’s possible to trade it to a larger stake with a lot more confidence and if a position starts to go wrong, you can get rid of your order very easily.

Every market that I trade is graded in this manner. When I approach a market, my stake rises and falls not only by what I expect to see but by how much money I think it’s going to trade. You can have low volume but high liquidity and vice versa. So looking at how much money is available and how quickly it is matching is useful to know.

When you look at a large race. There are some key advantages, but the key one is being able to jump on a position and if you don’t like it you can get out for no loss relatively easy. This is something that often isn’t possible on small races.

Why you don’t need a big bank to trade a big market

Where people get things wrong as they think then you need large stakes in a large market to make large amounts of money, whereas I know for a fact that that is absolute garbage!

If you look at that amount I got from the Melbourne cup this year there is a key factor. The race that stops a nation also stops the racing card somewhat. This year I had a good hour run into the big race. This meant the number of orders I could place in the market was high.

Because the markets are tradable for longer, you can put more than one order through the market and get instant settlement on your position. Most people won’t understand what I’m talking about here, but you have to bear in mind I came from financial markets. I’m showing my age, but I was trading short term on the stock market and one of the issues they had was the old settlement system. You would have to wait for trades to be settled. You could buy and sell, but you would have to wait for a settlement process to take place in order to receive your cash.

When I first started trading on betting exchanges the most remarkable thing about them was that they had instant settlement. You can actually buy and sell the same way that you would on a financial market, but you would settle instantly. The big benefit of this is that you can go back into the market the instant you’ve done one trade and, in the case of highly liquid markets, you can put through as many trades as you like as quickly as possible.

If I said to you that I traded one hundred thousand pounds through the market, you would think that perhaps I would need to remortgage the house and have a massive balance.

But the fact is, if you put a £5000 trade through 20 times you would reach your goal of £100,000 in total trade value. Though a slight exaggeration, even if we divided that stake up again into chunks of £200 and did two hundred trades, another boundary-pushing exaggeration, you would have matched £20,000 in the market. The reality is neither of these, but I hope you get where I am coming from. Trade more than one runner and you can divide that trade requirement by that number. You would be surprised how quickly those matched totals stack up.

Now of course, there is a skill to doing that unto itself. So not only do you have to understand the market and the trading style that you have, but you also have to be able to manage lot of those positions. But that’s one of the reasons you see a couple of subtle features that we have within Bet Angel that allow you to do this proactively and very efficiently.

I explain this in detail in the following video, where I give you a detailed example of a high turnover day.

Trading at a high level

Trading this way requires a level of skill in concentration that is beyond most people when they first start trading. It’s also difficult to narrate real time, as you are in and out and manage orders very quickly. The objective is to more or less not lose money and hope that most get matched and return a profit.

The key concept is to put plenty of orders in the market and manage the risk. Once you feel more comfortable managing that risk and using all of the facilities and tools available to you, then it becomes second nature. When you arrive at a market and exhibits the right characteristics it’s very easy to just sit down and start actively trading it in this manner. I’ve done this live on a number of occasions and it’s almost impossible to describe what is going on as it happens so quickly. It can be pretty intense!

Risky business

You have to be choosy though, as very often it’s not a strategy that works that well. Simply because the money is not there and the risk tends to be a little bit higher as well.

One of the characteristics that I’ve noticed within Betfair markets is they’ve been getting more and more volatile as time has going on. As a consequence, some of these bigger markets have got a lot more volatile than they used to be.

Because of this using larger stakes, it suddenly becomes a lot more dangerous when you’re active in the market. It’s quite possible you could get caught out with a move and a large amount of money and that’s going to hurt. You have to adapt your style depending upon what you see. When I say larger stakes, I’m merely talking about orders in the low thousands. It’s very rare for me to step up to bigger numbers. I prefer small and frequent trades as I’ve learned the more money you use the more chance it will impact your ability to do a profitable trade. Little and often is the key here.

Sometimes it will be obvious what stake you are going to use and how often. Other times you will need to get a ‘feel’ for how the market is filling your orders.

Practice makes perfect

Once you’ve traded a large number of markets over a large number of years. it becomes easier and easier to be able to identify when you’re doing the right thing.

Large markets don’t come around that often though and as a consequence, most people who are starting out on Betfair trading very often find large markets very alien in terms of the way that they behave and what happens within them.

But of course, you’re not going to get many opportunities in a year to be able to effectively trade them and that makes it difficult. They were for me when I started, but slowly over time, I figured it out. There isn’t really a short cut, just a lot of practice. Practice makes perfect, you just don’t get the chance to practice very often.

Summary

I love trading the big races. I realise a lot of people don’t like those big races, but for me, they present an opportunity to get some very large totals. So, when the opportunity comes around, I’ll always try and pull out a big result. As you’ve seen this year in most of the major races, I’ve been able to do that very successfully.

Your choice as a trader is perhaps to have more fun with these races and to try something a bit different. I can tell you now, that the main difference with them as they produce bigger volumes over longer periods of time and they tend to be able to hold stakes a little bit more effectively. It’s more or less about the balance of volume and liquidity you see in the market.

It can be a bit frustrating at times when you’re trading something and it’s generally not getting taken at a very high rate. But it’s OK to trade these with small stakes and small profits. I did exactly that for many years ago to gain confidence. From there, you can slowly increase stakes with as your confidence builds.

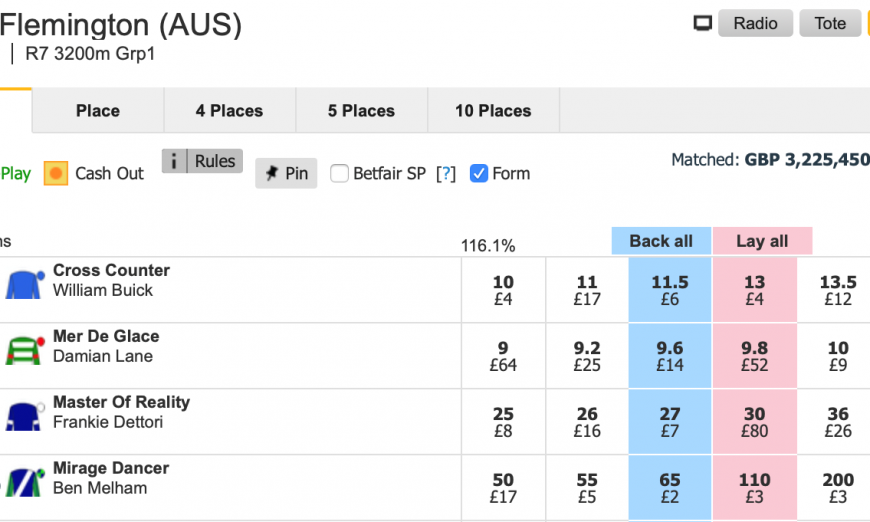

For anybody that is interested, my maximum exposure in this market was less than £10k in a >£3m market. That’s not my stake, that’s exposure and the ‘worst’ position I got myself into in this market. To put this into context if you had four £250 trades waiting to close in a competitive market like this at odds of 10, that would, roughly, be a £10k exposure with a £1k stake. I’m just a good old fashioned real trader, who is very practised and very good at what he does. Watch the videos and read all the articles if you want to learn how I trade. True trading is tough, but very rewarding if you learn how to do it properly.